Once each month, I publish an article on Seeking Alpha that pulls together some of my other pieces that individually look at small parts of the U.S. oil industry, namely articles covering the Permian Basin, Eagle Ford, Bakken,Niobrara, Utica, and Marcellus and Haynesville regions, as well as my coverage over the EIA's Short-Term Energy Outlook and OPEC's monthly piece on the global market. This month, I've done the same and I will talk about what this means for investors in companies like Memorial Production Partners(NASDAQ:MEMP), Approach Resources (NASDAQ:AREX), and Legacy Reserves (NASDAQ:LGCY), as well as for those in the United States Oil ETF(NYSEARCA:USO) and other oil-related ETFs.

Oil production to fall this year

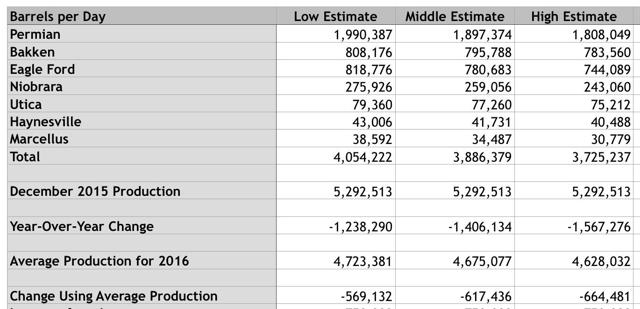

The fact of the matter is that, unless something big changes very quickly, oil production this year will be lower in the U.S. than it was last year. Last month, I determined the exact same thing but so many items have changed during that timeframe. In the table below, you can see, given the data I've calculated in my other articles, what the picture looks like for the seven major oil and natural gas producing regions in the U.S.

Based on the data provided above, you can see that, if we look at a conservative scenario whereby oil production is forecasted to fall the least compared to December of 2015, investors should expect for U.S.output to be about 1.24 million barrels per day lower year-over-year. Under the moderate (and most likely) scenario, we should expect December production to be down about 1.41 million barrels per day year-over-year, while the liberal (and least likely) scenario is calling for production to drop by 1.57 million barrels per day.

Of course, in that table, we need to pay more attention to the average decline throughout the year, since that's what matters so far as the glut is concerned. According to that category, investors should anticipate that production will have averaged a decline this year of between 569,132 barrels per day and 664,481 barrels per day. While this may sound like a lot, it's actually lower than the 830,000 barrel per day decline forecasted by the EIA, likely driven by a combination of different assumptions, combined with the fact that I'm not looking at the full production data for the U.S. (no reliable production data for the other miscellaneous sources seem to exist).

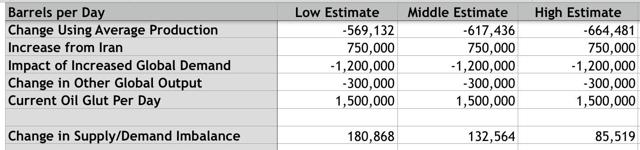

After incorporating my data and combining it with other changes expected for the year, which can be seen below, the picture is looking okay. If we are to assume that Iran meets its target of averaging a 750,000 barrel per day increase for 2016 and if we assume that OPEC is correct and other nations outside of OPEC and the U.S. will see output drop this year by 300,000 barrels per day and if we take the midpoint of many estimates and start off with the assumption that the global oil glut is 1.50 million barrels per day, we arrive at a build this year of between 85,519 barrels per day and 180,868 barrels per day. This is also incorporating demand growth this year in alignment with what OPEC has stated (1.20 million barrels per day) and it does not factor in supply outages because those are hard to estimate. In absolute terms, this implies additional stockpiles of between 31.30 million barrels for the year and 66.20 million barrels per year.

What others are saying

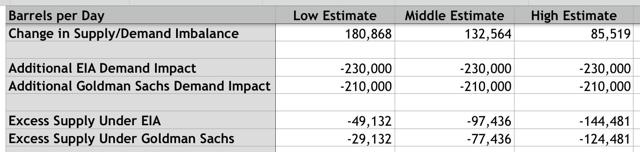

Overall, this looks negative and only looks good if we assume the EIA is correct in its forecast for U.S. output this year. However, it's important to keep in mind the fact that the demand figure above, pursuant to my decision last month, comes from OPEC, not the EIA. If we are, instead, dealing with the EIA's estimate of a demand increase this year totaling 1.43 million barrels per day or if we use the demand growth estimate of Goldman Sachs (NYSE:GS) that comes out to 1.41 million barrels per day, the picture looks far more bullish, as you can see below.

Based on these findings, if the EIA is correct or if Goldman is correct, the glut will vanish to the tune of between 29,132 barrels per day and 144,481 barrels per day this year. Overall, this calls for a decrease in the glut of between 10.66 million barrels and a whopping 52.88 million barrels. Although the low end there isn't really material, it's hard to argue the same case regarding the upper end of this range.

Takeaway

At this moment, the picture for the global oil market is better than it has been in a very long time. Even if OPEC's demand and production data is accurate, the picture doesn't look that bad and will certainly be better next year unless we see a surge in production. However, in most any other case, the picture looks very bullish this year instead of next year and investors should consider this to be a positive sign for oil-related companies and ETFs down the road.

Disclosure: I am/we are long AREX, MEMP, LGCY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: My LGCY shares are in the form of the company's preferred units