In February, Seeking Alpha contributor FX Metrix posited an interesting pair trade in the metals market: Short gold, long platinum. I've kept watch on this pair trade over the past four months but found the spread rather weak - four months for a 2% difference in two biggest ETFs tracking these metals: The SPDR Gold Trust ETF (NYSEARCA:GLD) and the ETFS Physical Platinum Shares ETF (NYSEARCA:PPLT):

While the direction of the pair trade seems right, this is a recent direction. In fact, year-to-date, GLD has been the stronger of the two ETFs. I.e., the inclusion of just one other month - January - skews the results:

My followers should be familiar with my stance on GLD, as I've written six articles here on the subject, and others elsewhere. In short, I believe GLD gets a bad rap for being zero yield, for its inability to be traded for physical gold, and for Warren Buffet's dislike of it. If you understand my stance on gold, the following pair trade recommendation - the topic of this article - should not surprise you:

- Long GLD

- Short a metal similar to platinum (I'll give you the specifics in a minute)

So why reverse the suggested pair trade? Don't get me wrong - I'm not arguing against FX Metrix's thesis. In fact, I believe he made several good points in his article.

However, if you want to run a pair trade in the metal industry, you must recognize that both of these metal prices are driven primarily by demand, unlike stocks, which can be driven by company fundamentals, financials, management, and a myriad of other factors.

Changes in company factors can break the correlation between stocks in the same industry or sector. Metals, in contrast, are almost always strongly correlated. For example, the four-month correlation between platinum and gold is 75%.

In this context, a pair trade on metals should be based on changes large enough to catalyze a decoupling of the price movements between the metals in question. Slight differences in scarcity and usages between gold and platinum were at the root of FX Metrix's thesis. Such differences cannot drive a large enough drop in the correlation between GLD and PPLT to be profitable.

The 2% gain in the trade FX Metrix recommended comes with a large opportunity cost. Anyone reading this article is likely looking for more significant ROI. Capital placed in a pair trade on two highly correlated stocks is usually is the wrong place.

That being so, I wouldn't recommend a pair trade in the metals industry without a strong reason to believe that the correlation between two metals will fall greatly in the future. I have a reason, and hence a trade. But this is a long-term speculative trade - not for the impatient, and not for the risk-averse.

So enough foreplay - let's get to the trade. We will be using gold via GLD and not platinum but palladium. Here's the play:

- Long gold via GLD

- Short palladium via ETFS Physical Palladium Shares ETF (NYSEARCA:PALL)

And before we get to the reasoning, note that PALL does not trade options. Thus, the short side of this trade will expose us to unlimited risk. This is why I said the trade is not for the risk-averse.

My prediction for the profitability of this trade relies on the upcoming automaker crisis. I have written about this topic in depth here. In short, the auto industry is now experiencing a subprime loan phenomenon similar to that in the housing market in 2007.

An important trend here is the price decline in vehicles, driven by a supply glut. With used cars becoming more popular, automakers will see diminishing sales - this is already happening. In turn, the need for metals used in the manufacturing of vehicles will also drop, dragging prices along with it.

Platinum and palladium are both important in the auto industry. You should now be asking, "Why palladium, not platinum?" The answer has two parts:

First, the automaker crisis is being "fueled" by subprime loans in the US market. The US market primarily uses gasoline for fuel, whereas Europe is more of a diesel market. Catalytic converters, the auto components responsible for reducing the environmental impact of emission fumes, differ by fuel type: palladium is used for gasoline; platinum is used for diesel.

Seeing as the subprime loan crisis is restricted or will at least start in the US market, palladium is the better short leg of this trade. But another aspect is important: the percentage of these metals that eventually become catalytic converters. For example, a trade on GLD based on a thesis about the jewelry industry would make sense, as 54% of gold demand comes from that market.

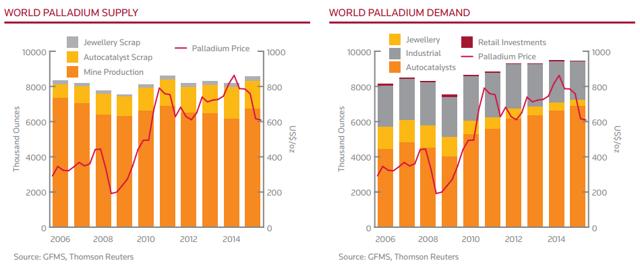

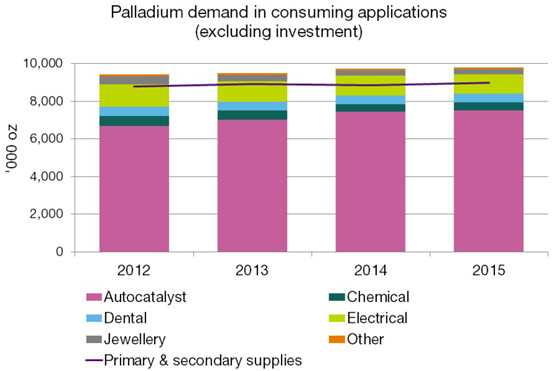

In this light - even if we were talking about the European market, which has a larger demand for platinum - platinum is not a good choice for the short leg: Only 37% of platinum demand comes from the auto market, which would make our trade highly peripheral. In contrast, 72% of palladium demand is from the auto industry, and demand has been rising:

That is, the auto industry controls most of the demand for palladium and is therefore highly correlated. With GLD and PALL showing a much lower correlation than GLD and PPTL, we can see how PALL should be the better choice here. A disruption in the auto industry can effectively decouple GLD and PALL.

A demand that has outpaced supply has bolstered PALL prices, which are already on the decline:

Imagine the results of the demand plunge from a weak auto market. A 50% reduction in demand from the auto industry could drop palladium prices by two-thirds, bringing the price back to its 2008 low. Seeking Alpha contributor Bull and Bear Investor also argues that palladium prices will continue to fall as a result of platinum replacing palladium in catalytic converters, electric car popularity growth, and recycling.

To summarize the short thesis:

- The auto industry's subprime mortgage crisis creates a supply glut of vehicles

- New vehicle sales drop

- Automakers reduce manufacturing output

- Demand for palladium, used in auto production drops

- The price of palladium drops, significantly as 72% of it is driven by the auto industry

As for the long thesis on GLD, I believe I've written enough on this topic and refer to you my other articles. But in addition to those points, the short thesis for PALL is also a long thesis for GLD. A subprime mortgage crisis in the auto industry can significantly affect the greater market, and GLD performs well during market crises.

Thus, the catalyst for PALL falling is also a catalyst for GLD rising. "Long GLD, short PALL" being a pair trade, we are hedged in the metals market. Pair trades are hedges by definition and are typically low-risk, low ROI trades.

However, this pair trade is different in that it has the potential for significant ROI. GLD can rally during a failure of the automaker market; PALL can crash. This is the decoupling of correlations I've been speaking of and it's exactly what can drive this hedge to be as profitable as a non-hedged speculation on a given stock.

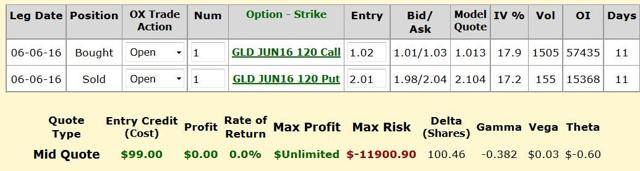

Still, we never want to buy GLD. Because GLD is taxed as a collectable and options on GLD are not, we want to use options strategies to go long on GLD. I suggest you create a synthetic long on GLD.

A synthetic long position allows you to mimic holding GLD without the tax issue. To create a synthetic long position, you sell one put and buy one call on GLD, both options having the same strike price and expiration date. Depending on your strike price, you can open this position at a net credit.

How long you want to hold the position will be the determinant of the expiration date. I don't find expiration date to be particularly important in a synthetic strategy because you can always roll short-term positions over and always sell long-term positions early. Here's an example of a synthetic GLD position, assuming you want to roll the strategy over every month (notice the entry cost):

Learn More about Earnings

My Exploiting Earnings premium subscription is now live, here on Seeking Alpha. In this newsletter, we employ both fundamental and pattern analyses to predict price movements of specific companies after specific earnings. I offer specific strategies for playing those earnings reports. To-date, we are 90% accurate on earnings report predictions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)