A range of economic shocks and growing global economic and geopolitical uncertainty are helping to support the price of precious metals. A rising gold price can only mean higher silver prices because of their closely correlated relationship. Silver has failed to keep pace with the rise in the value of gold and remains relatively heavily undervalued. The end of price manipulation and a declining artificial silver market will help to under pin higher prices.

I have expressed my bullishness regarding silver (NYSEARCA:SLV) a number of times on Seeking Alpha and despite the recent pullback in silver I believe that it still remains a solid long-term play.

After hitting a high of $18.02 per ounce earlier this month silver has pulled back sharply to now be down by almost 4% because of a recent rally in the dollar and the prospect of another rate hike this year.

Nonetheless, recent U.S. economic data were not as good as expected and this has led to the Fed will taking a more dovish approach to rate hikes, thereby taking the pressure of the prices of precious metals. As a matter of fact, there are now a range of reasons why silver remains a solid long-term investment opportunity.

#1 Gold has broken out of a protracted slump

Growing global economic and geopolitical uncertainty along with a weaker U.S. dollar, worse than expected U.S. economic data and signs that the Fed won't hike rates any time soon has caused gold to surge in value. There are in fact a range of indicators that the U.S. economic recovery is more fragile than initially believed and this means that precious metals, particularly gold (NYSEARCA:GLD)(NYSEARCA:IAU) will continue to appreciate in value.

If anything, it increasingly appears that a range of economic barometers and the true state of the U.S. economy has been misrepresented. May employment figures were far lower than expected and wage growth remains low, suppressing a growth in consumption and demand for credit.

The ongoing weakness of the U.S. economy which fundamentally can be attributed to the failure of the Fed's quantitative easing to provide any benefit to the real economy has left it vulnerable to the ructions of the global economy. The global economy remains weak and vulnerable to a range of economic and geopolitical shocks that can only continue to support the price of gold.

It is these factors which have helped to buoy the price of gold and allowed it to break out of its prolonged decline that saw it fall as low as $1,050 per ounce and now sees it trading at $1,273 per ounce. These factors along with the headwinds facing China will help to support its rally and place a floor under its price, with gold now having broken out of its protracted slump that commenced with the end of the gold bull market in early 2013.

Indeed, JP Morgan earlier in May came out and stated:

"We're recommending our clients to position for a new and very long bull market for gold . . ."

With silver sharing a close relationship with gold that sees their price movements being closely correlated, a positive outlook for gold and rising gold price bode well for silver.

As Erik Norland senior economist of CME Group stated:

"Although gold and silver are not perfectly substitutable, they exert a strong influence on one another as underscored by their strong and consistently positive correlation."

Any move higher by gold bodes well for silver with it set to follow gold's lead and continue to appreciate in value for the foreseeable future.

#2 Economic and geopolitical shocks abound

Important drivers of precious metal prices are market volatility, economic uncertainty and geopolitical shocks with gold being perceived by the market as the ultimate safe-haven and store of value. This means its price is not correlated to that of other assets making it an important hedge against economic and geopolitical upheaval.

Clearly, all is not well with the global economy, the Eurozone and Japan are caught in protracted economic slumps, there are fears of the outlook for China with it caught in a trillion dollar debt bubble and a range of emerging markets are experiencing declining economic growth because of the ongoing slump in commodities.

According to World Bank economist Ayhan Kose:

"The global economy is fragile. . . . , and growth is weak."

Sharply weaker commodities continue to impact emerging markets with the majority caught in the extractive trap, while the majority of developed economies are failing to gain any real momentum, due to a lack of consumption, deflationary conditions poor productivity growth.

In fact, there are growing signs that China's growth is unsustainable and it is facing a hard economic landing that would have a tremendous negative flow on effect for economies globally and particularly a range of fragile emerging and developed economies. This in conjunction with a range of geopolitical tensions across Europe and the Middle-East has the potential to disrupt global economic growth and financial markets, making gold an appealing hedge helping to support its value.

The majority of these issues are covered in my latest article 'The Rise Of Gold, China, And The Economic Barbarians At The Gate' and will help to sustain higher gold prices, with some predicting it could rise to well over $1,300 per ounce during 2016, which as discussed in the first point will boost the price of silver.

It is worth noting that as gold prices inch higher, the demand for silver for use in jewelry and investments rises because it is far cheaper than gold and investors are capable of buying greater volumes. These economic shocks will place a floor under the price of precious metals and help silver to continue appreciating in value over the long-term.

#3 Silver has failed to keep pace with gold

One indicator that silver is poised to continue rising in value and eventually outperform gold as a long-term investment is its failure to keep pace with the lustrous yellow metal. Over the last two years the price of gold has remained relatively flat yet silver has plunged by 10%, indicating that is relatively undervalued compared to gold. This becomes even clearer when taking a closer look at the gold-to-silver ratio.

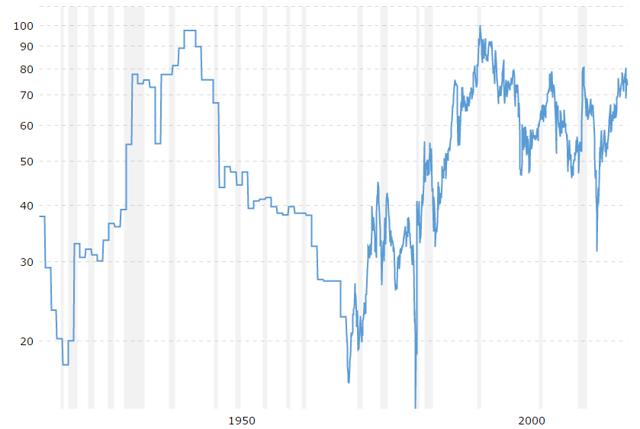

At the height of the gold bull market the ratio stood at 44 ounces of silver to one ounce of gold and two years ago required 66 ounces of silver to purchase one ounce of gold. Since then the ratio has deteriorated even further too now require 74 ounces of silver for one ounce of gold as the chart below shows.

This is well above historical norms with the ratio averaging 55 to 60 ounces of silver over the last 100 years. The deterioration of this ratio means that silver is now an intriguing buy and should outperform gold over the foreseeable future with the ratio set to move closer to historical norms, especially with god poised to rise even further in value.

#4 Silver' s greater volatility and the reduction of paper silver will boost prices

One of the key differentiating characteristics of silver from gold, is that the white metal is far more volatile. This means it is subject to far more violent price movements and the significantly higher degree of volatility is caused by a range of factors key among them:

- Silver prices have been depressed by a significant degree of price manipulation - in 2014 Silver traders brought claims against Deutsche Bank, HSBC Holdings Plc, Bank of Nova Scotia and UBS AG. Gold traders additionally sued Barclays Plc and Societe Generale SA. So far Deutsche Bank AG settled the lawsuits where it was named and the admissions of rigging will force greater regulatory supervision and prevent further manipulation, helping to bolster the price of silver. This is because the banks were keeping the price artificially low and were creating a large artificial silver market where paper silver instruments had a ratio of as high as 524:1 against physical silver.

- There is a tremendous volume of paper silver to physical silver in the market and this is suppressing the price of silver - it has been estimated that the paper silver market is 250 times greater than the physical silver market. This considerable volume of paper silver is what makes silver far more volatile and vulnerable to violent price swings because of a considerable disconnect between supplies of physical silver to artificial silver.

- The considerable volume of paper silver has suppressed the price of silver for years but its impact should lessen with as the artificial market starts to dry up in coming years. This will primarily occur because the allegations of price manipulation have left many speculators and investors in paper silver concerned that physical inventories are actually lower than previously believed, making physical silver a more popular investment.

- There is a far greater volume of silver traded compared to gold - this makes silver far more volatile than gold.

The end of price manipulation coupled with declining volumes of paper silver and its higher volatility means that silver offers considerable upside. These factors coupled with the increase in precious metals prices, especially gold, will give the price of silver a healthy bump and should see it appreciate as the laws of supply and demand have a greater influence over the white metal.

#5 Possesses the attributes of a precious metal and commodity

An important characteristic of silver is that unlike gold it possesses the attributes of both a precious metal and a commodity.

You see, silver unlike gold is widely used in a range of industrial processes and applications because of its conductive properties with it being the most conductive of the metals. As a result industrial demand for silver continues to rise with it an important component used in the manufacturer of electronic components such as LCD touch screens, LEDs, superconductors, stackers and other hi-tech components.

Indeed, demand for these types of components continues to grow strongly with them forming part of a range of consumer electronics such as cell-phones, tablets and flat screen TVs that continue to experience strong growth in demand.

Then there is the growing push globally for renewable energy and silver because of its conductive properties is a key ingredient used in the fabrication of solar panels. For 2015 demand for silver for use in photovoltaic cells grew by 23% compared to 2014 according to the Silver Institute and this was the second successive year where demand for silver for use in photovoltaic cells grew.

In an earlier article I estimated that China's ambitious solar energy targets alone would require 468 million ounces of silver to manufacture sufficient photovoltaic cells to meet its solar energy targets. Then there are the targets of other countries such as Germany, Japan, Brazil, India and the U.S. which will also markedly increase the demand for silver.

This growth in demand is occurring at a time when miners are cutting back on investment in exploration and mine development because of sharply lower silver prices. Such cutbacks are not only restricted to primary silver miners but commodities miners in general who are suffering because of the protracted slump in commodities including base metals such as copper and nickel.

You see, the majority of silver produced from mining is a byproduct of mining for other metals, with 55% coming from the mining of base metals such as copper, lead, and zinc alone. Then another 13% comes from gold mining and the remainder from primary silver miners.

The constrained supply situation will take some time to remedy because of the long lead times associated with recommencing production at operations that have been shut down and/or placed on care and maintenance.

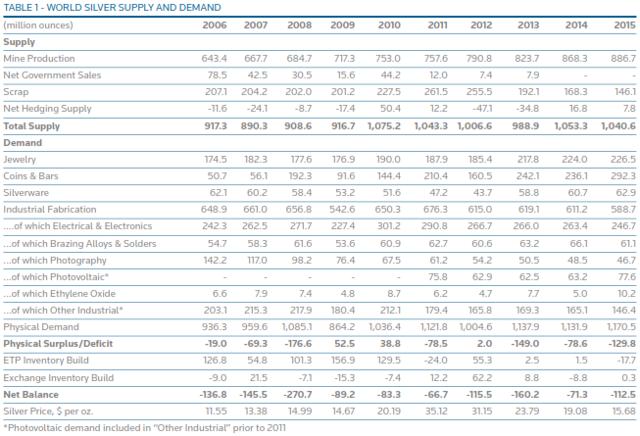

Over the last three years there has been a deficit of physical silver with it reaching as high as 130 million ounces in 2015 as the chart highlights.

Source: The World Silver Institute.

This is expected to continue into 2016 and 2017 which when coupled with growing industrial demand for the foreseeable future should help to drive silver prices higher.

Another interesting aspect of this deficit is that silver prices remain depressed, despite silver being in deficit for seven of the last 10 years, and it is this which highlights just how heavily the silver price has been manipulated by the banks.

The basic rules of supply and demand dictate that prices should rise during times of supply deficits, yet this clearly has not occurred. This can be attributed to the tremendous volume of paper silver coupled with the banks mentioned earlier in point 4 openly engaging in price manipulation and suppressing the price of silver for years.

As a result the price of silver can only rise as the effects of the price manipulation decline, with it estimated the silver inventories are primarily comprised of paper silver.

Final thoughts

The last few years since the end of the precious metals bull market have seen a volatile and uncertain rise for investors but there are signs that a recovery is in sight. It appears that silver is the best long-term precious metals investment with a range of factors including the end of price manipulation, falling volumes of paper silver, growing physical demand, a supply deficit and a rising gold price all set to push its price higher. Higher gold not only means higher silver prices because of their closely correlated prices but also because the use of silver bullion for investment and jewelry increases because it is cheaper substitute for gold.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I/we have extensive investments in physical gold and silver bullion as well as collectible antique gold and silver coins.

.png)