At least one thing is for certain (or close to), the probability for a much hotter than normal summer is in the mix this year.

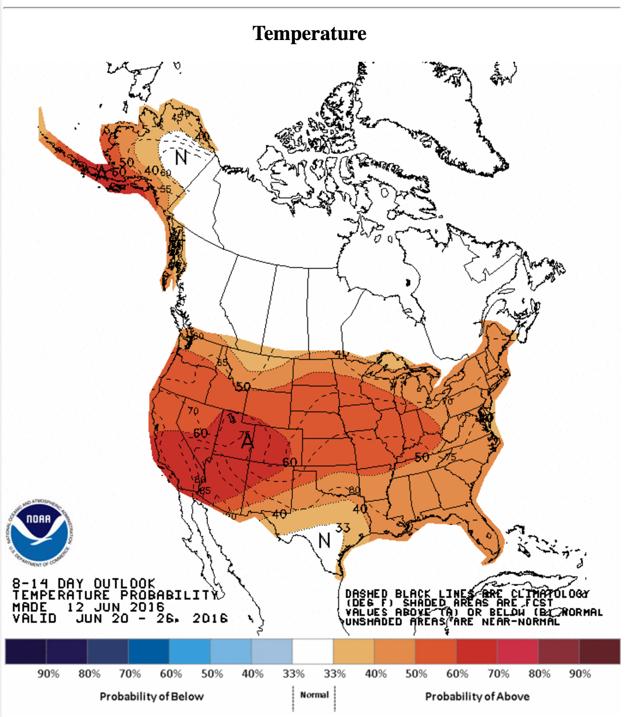

Here's the latest NOAA 8-14-day outlook:

Boy, does it look hot, and as natural gas bulls, a map full of red in the heat of the summer is a sign that storage injection numbers will be low.

As a reader pointed out in one of our recent write-ups, the map isn't an indication of "how" hot the temperature will be, rather it merely illustrates the probability that the temperature will be above average. Of course, this runs the probability that the temperature could be below average. The darkness of the red indicates the probability of higher than normal temperature. So for summer, natural gas bulls want the map to be red hot. The darker the red, the nastier things could get, and thus increases the potential for more cooling demand.

On the supply front, US gas production averaged around 70 bcf/d last week, while Canadian gas imports rose. Even with one of the more bullish storage reports last week, we think there could potentially be much more bullish reports ahead. While we can't be certain of some of our weekly forecasts, there could be some weeks where we see consistent back to back 20 bcf builds, and this would be extremely bullish for prices.

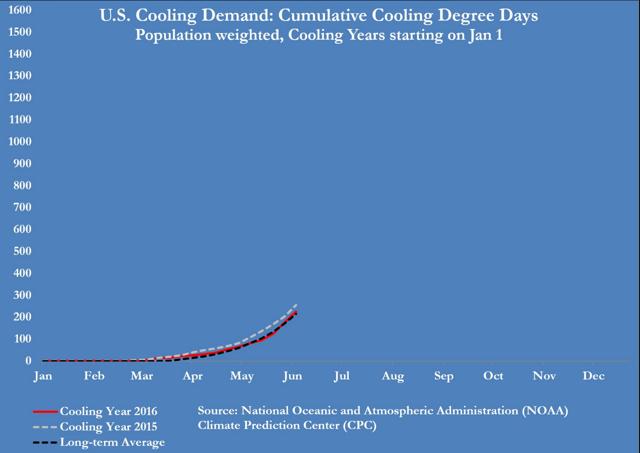

Here's a look at AC usage relative to last year:

Despite cooling demand averaging slightly lower than last year thus far, US gas storage has built considerably less than 2015. The main reason for the difference is the 4 bcf/d in supply, 0.6 bcf/d demand from LNG, and 1.2 bcf/d in Mexico gas export. If you add up all the differences, it's a delta of 40.6 bcf on a weekly basis, which is quite substantial. Even with the weather being not as supportive, structural demand increases and supply stalling are helping storage injections. Can you imagine once we get supportive weather?

Remember, natural gas requires paying close attention to weather forecasts, but structural demand increases and supply are just as important. We think Mexico gas exports should be over 4 bcf/d by the end of this month, and with Cheniere's train 2 coming online in August, it will help with the surplus storage.

We think natural gas is one of the best cyclical plays as the favorable structural demand increases combined with the potential for a very cold winter could really boost prices upwards. As a result of our bullishness, we have we have positioned a large percentage of the HFI portfolio in natural gas (NYSEARCA:UNG) producers that will outperform significantly if prices continue to recover. We think the fundamentals are pointing in the right direction. As storage surplus decreases over the next several months, market participants will begin to reevaluate.

Since its launch, the HFI portfolio has outperformed the S&P 500 by 17.07% and returned 27.72% on a gross basis. For investors interested in how we are managing the portfolio, please consider signing up for our premium service.We look forward to you joining the HFI community. And as always, if you liked our natural gas daily write-up, please be sure to click follow and read our other articles as well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)