|

.jpg) Once again we find the market in 'batten-down-the hatches" mode, reflecting the uncertainties of a looming Fed meeting this Wednesday, the 'Brexit' vote in the UK next Thursday and the end-quarter-focus on earnings. Stir in the always-brilliant presidential election political discourse, a triple-witching hour this week and the horrific news from Orlando and you have a great list of imponderables for the market to process. As usual, the reaction to uncertainty is to sell risk (stocks) buy safety (bonds, especially sovereign credits). Once again we find the market in 'batten-down-the hatches" mode, reflecting the uncertainties of a looming Fed meeting this Wednesday, the 'Brexit' vote in the UK next Thursday and the end-quarter-focus on earnings. Stir in the always-brilliant presidential election political discourse, a triple-witching hour this week and the horrific news from Orlando and you have a great list of imponderables for the market to process. As usual, the reaction to uncertainty is to sell risk (stocks) buy safety (bonds, especially sovereign credits).

In the Eurozone "Brexit's" the word…

It refers to the proposed vote in England on a move to leave the European Economic Union. A vote will take place June 23. I'm not certain what this will mean because the UK is not part of the currency union. There are those who speculate a British departure would mean a painful ending to, and unwinding of, the entire union. On the surface all it would seem to do is make trade and travel between England and the continent more difficult. Nervous Germans are accepting .019% on their 10-Year Bund, with nervous Japanese (living in a stagnant economy, seemingly non-responsive to fiscal and monetary stimulus) receiving a minus .161% interest rate for the guaranteed return of their 10-year security. This vote does cloud the future… and all investors hate uncertainty. Polls are beginning to reflect that UK voters may be getting warmer to the idea of cutting the cord. On the plus side, all of this created a good bid for US Treasury securities (the best house in a bad neighborhood). Our 10-year went out Monday (6/13) at a 1.61% - within 6 basis points of the Feb '16 panic low of 1.55%.

Meanwhile, back on the other side of the pond…

It was reported that total employment was up by only 38,000 jobs, way below the 162,000 estimate. According to one of CNBC's valued sources (Dan North (chief economist at Euler Hermes) "There's one word for it, which is just shocking. Unfortunately, it does look like a trend. It's not great news." Yes, last month's number was below estimate, too (ergo the trend comment). But also, the number of Americans leaving the workforce in May was 664,000. With this big drop in the workforce came a drop in the unemployment rate to 4.7%. There is no break-out for the number who left the workforce to account for the "WHY?" In other words, when I left the workforce in 2012 I retired and did not look for work. There is a tendency among the bears to assume the lion's share of the 664,000 are people frustrated and giving up the ghost of trying to find work. 300,000 Baby Boomers reach retirement age each month. Not all will retire, but as they do you can get some significant distortion in this number. Meanwhile, the Job Opening Labor Turnover Survey (JOLTS) report for April showed 5.8 million jobs open for hire (openings without skilled workers to fill them.). I find this shocking. The idea that the miss on the jobs number is bad news is ridiculous. If anything we are entering a much tighter labor market - good for incomes, bad for inflation.

What a great time to turn bearish!

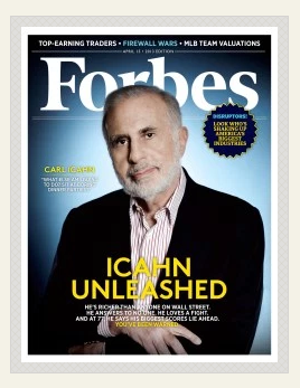

With the S&P 500 up 16% from the February lows (knocking on the door of a new all-time high) you'd have to think it was vulnerable to corrective action. It brings out a cavalcade of negative punditry: some trying to make a name for themselves, others who made a name awhile back trying to embellish it again, and some talking their own book, trying to take advantage of the negative sentiment to line their own pockets. This swoon is no acceptation.

Take it from the 'Magi'

Our three wise men include Bill Gross, George Soros and Carl Icahn. The first knock on the market came last week from George Soros and a report that he'd turned very bearish and taken a huge position in Barrick Gold (NYSE:ABX), a position that was up $90 million since the end of the first quarter. He had also put on significant hedges vs. his US equities. International economic issues are a concern, in particular China (where he has been flashing warnings for several years). Soros is a brilliant player with an estimated net worth of $24 billion. (A look at Soros' recent calls)

Icahn, who has been badmouthing the market for months and seems to be most visible with his negative comments when the market begins to sell off, came out with a statement concurring with Soros' concerns. Again, a very successful investors/ trader/ greenmailer, Icahn is probably trying to add fuel to the fire that may already be going on his negative bets… talking his own book. (Here's Icahn call we talked about an October 2015 kortsession post.)

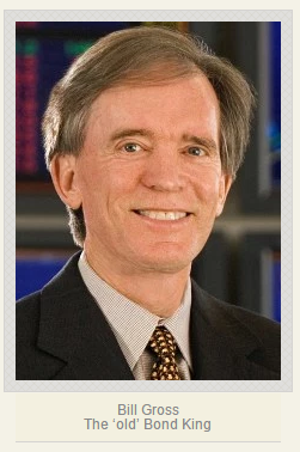

Finally, there is Bill Gross. who says, according to CNBC, negative yields are a $10 trillion "supernova" that will "explode." What can I say? (Here is the video.) Gross, an incredibly successful fixed income investor, in recent years has been in "pundit hell." Here's a kortsession post from 2013 that goes after one of his dire pronouncement-"Be afraid, very afraid." I can see many beneficiaries of low rates. I see savers in fixed income or CDs as the losers. I agree rates can and should go up. I'm just having trouble with the "exploding supernova" when this happens. I'm not sure I get the message here. I do know his negativity does nothing to help sentiment; which, thankfully, is already pretty negative.

Again, we find the market preparing for the next disaster. With all due respect to the Magi and others, this all feels like normal corrective action, not the end of the world.

What's your take?

Disclosure: The information presented in kortsessions.com represents my own opinions and does not contain recommendations for any particular investment or securities. I may, from time to time, mention certain securities for illustrative purpose, names where I personally hold positions. These are not meant to be construed as recommendations to BUY or SELL. All investments and strategies should be undertaken only after careful consideration of suitability based on the risks, tolerance for risk and personal financial situation. |