IEA

"Global oil markets to balance out," IEA says.

What a shocker, and don't let us be the first ones to tell you just how silly the IEA sounds 99.99999% of the time.

The International Energy Agency (IEA), founded in 1973 in the wake of the 1973 oil crisis, has since then provided statistics and analysis on oil markets.

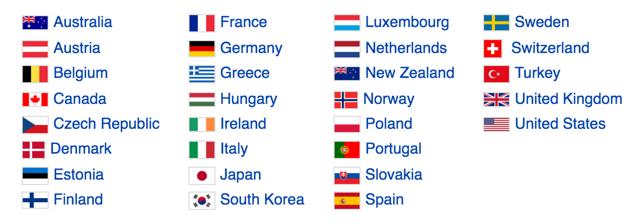

Members of the IEA include:

Earlier this year precisely when oil (NYSEARCA:USO) prices were beginning to bottom out, IEA said:

This was on February 9th, 2016, and ever since then, well, you know the story.

Thank goodness the IEA doesn't actually manage money, we can't imagine how happy their investors would be at the moment.

IEA's purpose is NOT to forecast oil prices, yet it does exactly that. To be exact, this is what IEA's mission statement says:

"The IEA is an autonomous organization which works to ensure reliable, affordable and clean energy for its 29 member countries and beyond. The IEA has four main areas of focus: energy security, economic development, environmental awareness and engagement worldwide."

We have NEVER been fond of IEA's analysis or their ability to make any reasonable forecasts. If you don't believe us, just scroll through some of their old work and you will see what we are talking about.

Today, the IEA came out and said that the global oil markets are now moving close to balance by the 2nd half of this year. While still lacking the ability to perform math skills, IEA still expects there to be a build in crude inventory around the world in the 2nd half forgetting that Nigeria's production is offline by 1.5 million b/d now, and that countries like Venezuela are having a hard time keeping the lights on. Nonetheless, IEA still attempts to make forecasts for oversupply and perennially below demand forecasts.

We think market participants should take what IEA says, crumble it up, and toss it in the waste basket. If you want to see what an incompetent agency full of political agendas look like in forecasting the oil markets, look no further than the IEA.

Everyone expected the oil markets to balance by the 2nd half of 2016. The unforeseen outages simply accelerated the inevitable rebalancing process. With global capex down two years in a row, the focus for the IEA should be the security of the future supply of oil, and not making ridiculous forecasts for where prices will go. The question we simply do not see them answering is what will happen to the global oil supply by 2018-2020? Will shale production be capable of keeping up with demand growth AND replacing the yearly conventional production losses?

Perhaps it's the short-term mindset of the market, but IEA's role should be to understand energy security, and not oil price forecasts. Energy security is the result of where prices go, so the logical thing should be to assess where supply will come from IF prices stay here. And for those that haven't heard the phrase, "Low commodity prices cure low commodity prices," then we suggest looking at history for indications as to what happens to supply when global capex spending drops.

Surprise, supply also drops.

It's not hard to see that if demand continues to grow around the world, there could potentially be a shortage of supply by 2018. Yet, we have not seen the IEA stress about this issue in these updates. The tone of the updates should be that oil prices need to go up fast to ensure that we have enough supply in the future years ahead, but 1973 was nearly 43 years ago, and many people have forgotten what it's like to have an oil shortage.

In the end, we appreciate the IEA for telling us the obvious. We thank them for issuing a demand forecast for 2016 only to revise it up to 1.6 million b/d. We thank them for the warning sign they gave on February 9th telling us how the world is awash in oil. And we most certainly thank them for the amazing forecast abilities they have. Because in the end, without forecasters like the IEA, investors that are truly contrarian wouldn't stand out.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)