Some time around summer of last year, it became fashionable to talk about petrodollars.

The sellside had put out a few notes, starting with SocGen in November of 2014 and then BofA and Goldman in early 2015, but it still didn't feel like the market was fully aware of the seismic shift brought about by plunging crude prices. Oil producers had been net exporters of capital for years, which meant there was a near constant bid for liquid, risk-free assets, most notably, US Treasurys. Here's Goldman to quantify:

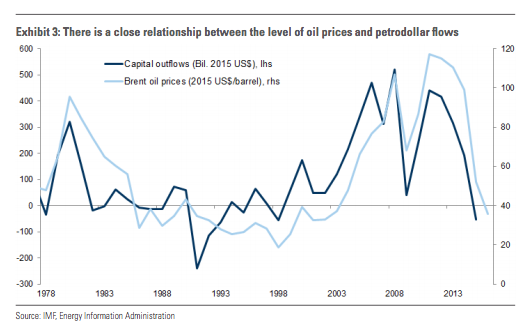

Between 2006 and 2014, capital outflows from oil-producing EM economies averaged $330bn per year (in 2015 dollars), equivalent to 0.5% of global GDP every year. Yet, in 2015, following the fall in oil prices, the current account surpluses of these economies disappeared and many started to import capital.

(Chart: Goldman)

But you know what's funny? It wasn't plunging oil prices or the news that Saudi Arabia was going to tap international capital markets to help mitigate the SAMA burn that woke everyone up. No, it was China that sounded the alarm bell.

I've said this before and I'll say it again: the August devaluation of the yuan isn't well understood. They didn't move towards a more market-driven exchange rate. As BNP's Mole Hau described it, they used to manipulate the fix to control the spot, now they manipulate the spot to control the fix. Guess which one is more expensive in a pinch?

And so, when China devalued on August 11, the market got spooked. Everyone simply assumed a larger devaluation was in the cards and the pressure on CNY increased. The PBoC started burning through reserves to prop up the yuan and mitigate outflows.

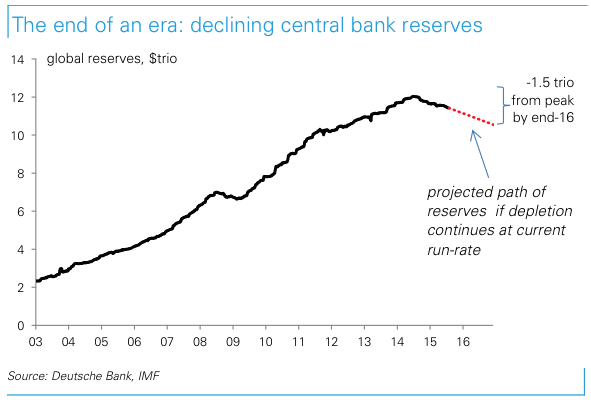

It was at that point that everyone suddenly woke up. "Wait a minute," the market said, "it seems like we've heard something about reserve liquidation before over the past six months." Then it dawned on everyone: China was selling its reserves just as oil producers and commodity-dependent economies were tapping their rainy day funds. The "Great Accumulation" (as Deutsche Bank called it) was over. "Quantitative tightening" had begun:

(Chart: Deutsche Bank)

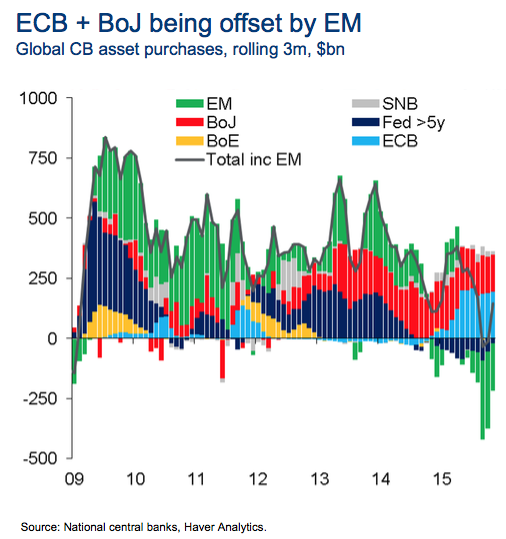

The question then became this: To what extent will China, Saudi Arabia, and others offset the efforts of Europe and Japan with regard to the purchase/sale of high quality sovereign debt. That is, if the Chinese, the Saudis, and a whole bunch of other people are selling to protect against capital flight and falling commodity prices (respectively), then is QE nothing more than an effort to maintain the status quo? Here's one more way to conceptualize it: If EM is selling, then is the only purpose of European and Japanese QE to keep things neutral? If so, that's not good. It's supposed to be stimulative. It's not supposed to be a band-aid.

Well, as I noted early on Friday, there was indeed a time in the not-so-distant past when flows out of EM more than eclipsed ECB and BoJ stimulus. That is, global central bank asset purchases turned negative:

(Chart: Citi)

Through it all, the focus has always been on government bonds. Specifically, the market wanted to know how much in US paper the Saudis and China had sold. Last month, Treasury broke out the numbers on Saudi Treasury holdings for the first time in decades and the number was underwhelming: $117 billion. So, just a little more than China sold in one month late last summer. Of course, no one knows how much is held in custodial accounts in "other" places. Other places like Belgium.

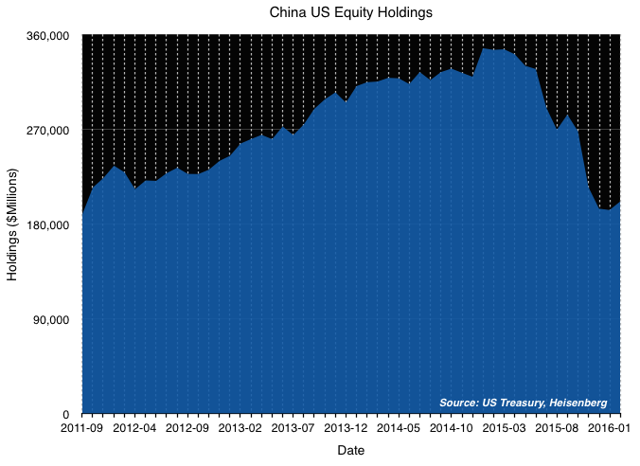

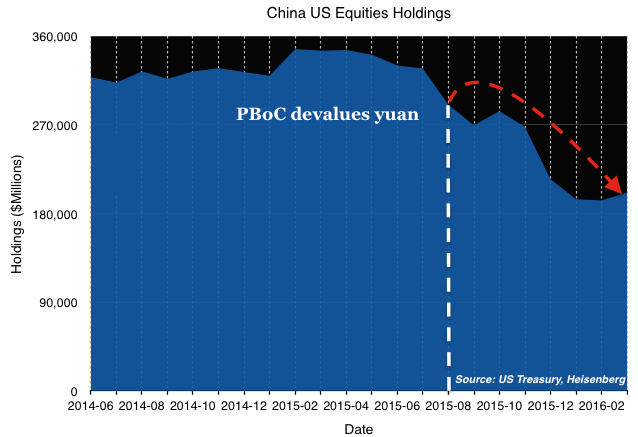

This week, the focus shifted from US debt to stocks. That's right: US stocks. Thanks to data from the Treasury, we now know that from February of 2015 through March of this year, China sold some $147 billion in US stocks, or around 42% of their total holdings:

As Brad Setser, a senior fellow at Council on Foreign Relations in New York told Bloomberg, "China's U.S. portfolio doesn't just consist of Treasuries. To gauge China's activity in the market it's increasingly important to look beyond the Treasury market."

Indeed. Here's a bit more color:

Switching to selling stocks allows the PBOC to retain safer, more liquid assets such as Treasuries that it can unload easily in times of turmoil. Two rounds of declines in the yuan in the last 10 months spurred market volatility worldwide and led investors to monitor China's reserves as a measure of how much of its war chest the country was burning through to combat capital flight.

Dumping equities may prove to be a savvy move, considering that the S&P 500 Index has gone 13 months without a new high on a closing basis. China, which more than doubled its holdings of U.S. stocks during the bull market that began in 2009, wouldn't be alone among government-affiliated sellers of investments abroad. Sovereign funds from Qatar to the United Arab Emirates and Russia have been liquidating assets since crude began tumbling in 2014.

Right. And we'll come right back to the latter point there. But before we leave China, note that the selling gained momentum just as the PBoC devalued, leaving little doubt as to who in China was selling. Let's zoom in:

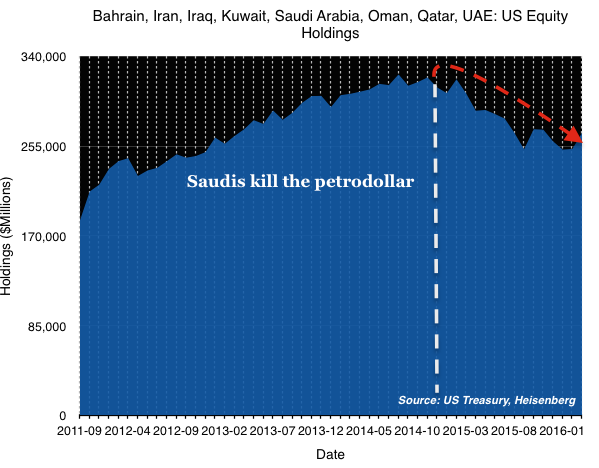

Now, about those "other" sovereign sellers. Have a look at the following graphic, also derived from Treasury data, which shows that "Asian oil exporters" (which the government goes on to define as Bahrain, Qatar, Kuwait, the UAE, Oman, Iran, Iraq, and of course, Saudi Arabia) sold some $53 billion, or around 16%, of their US equity holdings in the wake of the Saudi's move to crush crude in late 2014:

So between OPEC and China, roughly $200 billion in US equities were sold between November of 2014 and March of this year.

That's larger than the SPDR S&P 500 Trust ETF (NYSEARCA:SPY). By a lot.

This is rather emphatic proof of the contention that you absolutely have to adopt a holistic approach to investing in today's environment - even if all you care about is US stocks. This has become one giant, interconnected liquidity regime and you have to be able to analyze it as such.

Finally, you should think about how politics influences the ebb and flow of global liquidity. For instance, note that the Saudis threatened to sell a quarter trillion in US assets earlier this year if Congress passed a bill that would allow the Saudi government to be held accountable in court for any role in 9/11.

You can bet China has probably communicated similar threats in relation to the South China Sea dispute.

From the looks of things, there's still plenty more to sell.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)