The Eurozone "Summer of Discontent" discussed in the last report continued to simmer on the boil. The threat of the Brexit and other populist agendas puts the European Union ((EU)) at risk; which knocks on to the survival of the Eurozone by default. There is an alternative to dissolution, which is reformation. The reformation has not yet been factored in by pundits, however there are signs that it is a growing probability. It may begin even begin in Germany, but not in the way that people expect. There is also the possibility of "re-formation"; that may begin in France.

The Eurozone "Summer of Discontent" discussed in the last report continued to simmer on the boil. The threat of the Brexit and other populist agendas puts the European Union ((EU)) at risk; which knocks on to the survival of the Eurozone by default. There is an alternative to dissolution, which is reformation. The reformation has not yet been factored in by pundits, however there are signs that it is a growing probability. It may begin even begin in Germany, but not in the way that people expect. There is also the possibility of "re-formation"; that may begin in France.

(Source: Bloomberg)

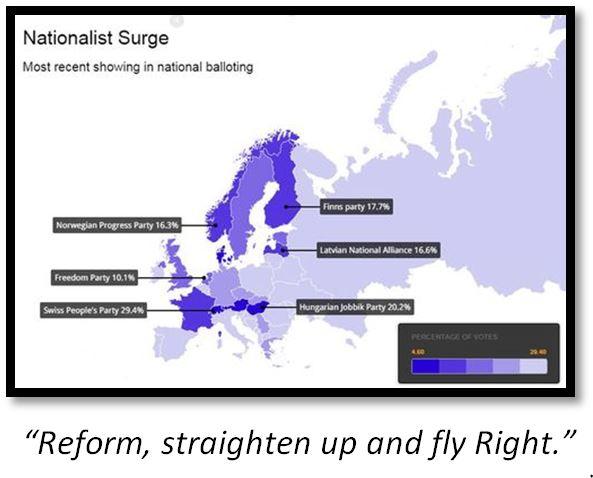

There will be those mainly within the European Union ((EU)) who will blame Britain, if it votes to Brexit, for the demise of the Eurozone in general. Whilst this is politically expedient it denies the reality that forces within the Eurozone are breaking it up, without the influence from Britain. Austria has already begun a reformation by embracing the Far Right agenda on immigration. For survival, the Eurocrats may find that they are obliged to follow suit to straighten up and fly right.

Dutch Prime Minister Rutte, facing the dismal prospects of an election next spring recently zagged Right, with an open commitment to form a coalition with the Freedom Party if required to do so. In order to survive, the Eurocrats are now keeping their political enemies closer. This will lead to them seizing these enemy agendas and then modifying them once political survival has been attained.

Despite all of the growing political tensions, the ECB has remained steadfast in its adherence to the line ,that it will wait to see the future benefits of its last easing move. Governing Council members Jan Smets and Ewald Nowotnyreinforced this message. Governing Council member Bostjan Jazbec laboured the point, for those who are slow on the uptake. Lest there be any doubt left in people's minds, Jens Weidmann then flogged the dead horse with even greater vigor. For Weidmann, sitting tight waiting for the last ease to work could be a lengthy process; based on his assessment that the 2% inflation target only needs to be achieved over the medium term.

Governing Council member Ardo Hansson made it clear that in the event of more easing or staying on hold, that the ECB will not reverse its easy policy for a considerable time. Since the deflation headwinds have been acute, Hansson believes that the easy policy should linger for a considerable time after the process has officially ended. He also feels that the new QE strategy of corporate bond buying will be more successful than the previous government bond buying phases. In short, since inflation has undershot for some time it should be allowed the potential to overshoot.

Building on Hansson's theme, Spanish central bank governor Luis Maria Lindebelieves that the ECB is well behind the Fed, BOJ and Bank of England when it comes to QE. In reference to the ECB's QE programme he commented that: "I'd (Linde) like to clarify that while the effect of the asset purchase programme is important, we're a long way from levels reached by the other three central banks." Following Hansson and Linde's train of thought, there is significant room for the ECB to expand monetary policy further, once the current programme ends.

The ECB appears to be worried that conditions may have deteriorated so much over the summer, before Mario Draghi speaks to the German parliament, that some remedial action is already required. French Governing Council memberFrancois Villeroy de Galhau recently went to address German lawmakers in their own language. He set the stage before embarking on his trip by opiningthat there is no need for further stimulus; and that focus should only be on executing the stimulus agreed back in March. This was intended to allay the fears of the Germans that the ECB is going to go off on one (in monetary easing terms) yet again.

De Galhau chose to frame the German criticism of the ECB's expansionary monetary policy as a communication challenge. The ECB has allegedly failed toexplain itself well, so that Germans apparently (incorrectly) assume that it is monetising national deficits. Perhaps by talking to his critics in their own language, he was attempting to overcome this communication problem. He then neatly seized on one of Jens Weidmann's own statements, that monetary policy is not just for savers, when he stated that policy cannot be made for one nation alone.

Since he was born in Strasbourg and his family which is from the German Saarland retains an interest in the Villeroy and Boch chinaware company, his mission was supposed to elicit the spirit of Franco-German cooperation which apparently still holds the Eurozone together.

Objectively speaking however, his presence and lineage evinces the kind of cosy nepotism that infuriates Germans about the European Project. It all seems to be about connections and elitism, rather than about meritocracy and democracy. His attempts to reassure German politicians may therefore have unnerved them; and also made them feel that yet another cozy Eurozone solution was being forced upon them. It therefore still remains to be seen how the ECB can prove to the German voters and the Constitutional Court that it is not monetising national deficits.

After Villeroy de Galhau's sighting shot, Draghi signalled that he intends to put the ball firmly back in Eurozone politicians' hands. Eurozone politicians have been all too happy to let the ECB do the heavy lifting, whilst they shirk their responsibilities on fiscal discipline, economic reform and fiscal stimulus.

Draghi put the politicians on notice that, whilst the ECB is committed to fighting deflation, they must be rational partners and seek to create the structural platform for growth. Perhaps to put more pressure on the politicians, Governing Council member Erkki Liikanen repeated that the monetary prop of Helicopter Money was not and is not on the table.

Draghi's assertions and the politicians' behavior highlights an interesting dilemma, that must get played out in the near future. Eurozone voters have shown their dislike of the current policy makers in Brussels. These same voters have however also shown a distinct apathy towards structural reforms that will make them more globally competitive.

What the people of the Eurozone want are barriers to competition as well as barriers to immigrants erected around them. In a world of trading nations, this populist reaction will have severe negative consequences for them. Neither do they want fiscal austerity or the obligation to pay higher taxes for fiscal expansion. In effect they just want an easy life.

The Eurozone is in need of a reality check. Currently it is undergoing the blame game of pointing fingers and apportioning blame, rather than the realization of economic necessity. Populism appears to offer the opportunity to have everything at no economic cost. Whilst Draghi lectures policy makers, on the need to apply reforms, his provision of easy money provides no incentive to execute said reforms. The Eurozone therefore needs a wakeup call on both the pitfalls of following populism and adhering to the current status quo.

Since Germany has been the loudest critic of the ECB's policy for creating populism and the rise of the Far Right, it would be apposite if the wakeup call appeared there first. It would also be a lesson for the self-serving career politicians like Wolfgang Schaeuble who shift blame onto others in order to hide their own short-comings. Watching Mario Draghi position himself for his day or reckoning with German politicians it is useful to imagine just how he may trigger this wakeup call. He is on record already for saying that ECB policy should not be made for the benefit of German savers, so in fact the epiphany that he may be creating has already started.

It is an acknowledged fact, that German industry has benefited more than any other sector in the Eurozone economy from the single currency. The loss of the competitive devaluation option by Eurozone nations, effectively took away a big competitive threat to German industry which was famously ossified at the time of Euro's creation. Germany has thus benefited from Eurozone membership more than its neighbors. In fact a case could be made for saying that its neighbor's' weak economies have been created in some part by the loss of the devaluation option. The German trade surplus, which recently hitnew monthly highs, is thus a consequence of Eurozone membership.

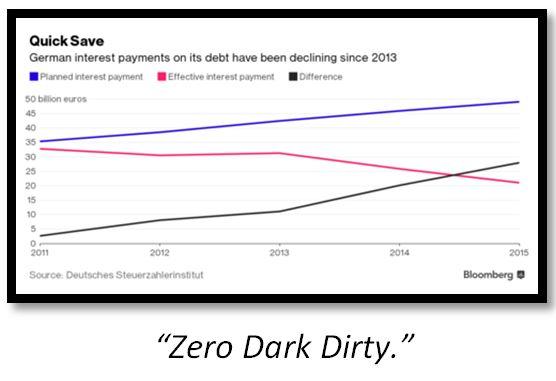

(Source: Bloomberg)

Currently Germany holds up its budget surplus, affectionately called "Schwarz Null" ("Black Zero") as a beacon of fiscal probity for its neighbors to follow. What if it could be shown, that this surplus was a consequence of Eurozone membership? A study by Karolin Herrmann at Deutsches Steuerzahlerinstitut, a fiscal policy think tank, shows that the "Black Zero" is a consequence of one-off factors; the main driver being lower interest payments on Germany's public debt. Such a bombshell in the hands of Mario Draghi, in front of German lawmakers, would be an interesting spectacle. It would also light the fuse of a big wakeup call across the Eurozone.

Germany's twin surpluses can therefore be directly traced back to Eurozone membership and ECB policy. Suddenly, Germany is framed as the biggest loser from a Eurozone breakup, rather than the winner that the German populists claim that it will be. Under such circumstances, German complaints about the Eurozone would be placed in a totally different context. Germany would appear to be suborning the Eurozone to its own national agenda; and then mistakenly walking away from it when it allegedly no longer suits its purpose.

The whole debate about those who have abused the Eurozone for their own pecuniary advantage would be out in the open. The Eurozone institutions would thus be forced to rebuild themselves in a way that gives priority to sound economic and political governance. The Eurozone may therefore be about to have a reformation rather than a dissolution. Mario Draghi may also be a key individual in this reformation. If such a reformation occurs, the Eurozone will actually become less German, rather than more so, which may surprise many Europeans and shock most Germans.

As Mario Draghi and his team prepared for their showdown with German lawmakers, the Germans did some preparation and groundwork of their own at a summit on their own turf. Jens Weidmann pursued the line of debate which states that an extended period of low interest rates, increases the risk of a sudden spike in yields which destabilizes capital markets and the real economy. In layman's terms, portfolio manager returns become dominated by the hunt for yield; that then morphs into the hunt for capital gains when there is no yield premium to be had. When the music stops and the ECB no longer obliges with further interest rate cuts or monetary expansion, the violent unwinding of the crowded longs becomes the spike.

Some members of the ECB Governing Council may also be in need of a reality check. Ignazio Visco is chief among them. Speaking recently, whilst acknowledging that there is a risk that consumers elect to hold physical cash rather deposits he does not believe that this behavior has become significant at this point. There will be many consumers and banks in Bavaria rushing to prove him wrong. He also seemed to tempt fate to the limit when he also opined that: "We think that financial stability cannot be and should not be a priority for monetary policy." Such inflammatory talk not only invites a financial crisis, but also puts the ECB back in the firing line for creating a crisis rather than an economic solution.

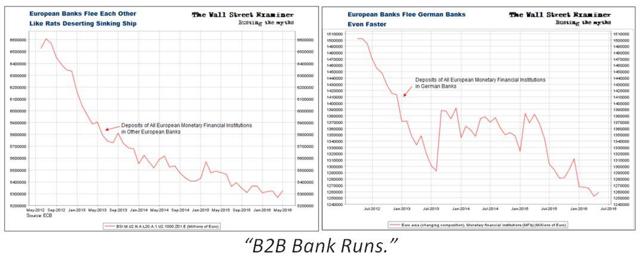

(Source: The Wall Street Examiner)

The lack of belief in financial stability is evident in the continued run by small banks on big banks within the Eurozone. Despite all the policy maker positioning for Eurozone banking union, the banks themselves are moving in the opposite direction towards national taxpayer funded safety. This bank on bank run just took a new leg down in Germany, in response to the arrival of negative interest rates from the central bank that does not prioritize financial stability.

The German leg down in the bank on bank run, is also part of a more dangerous traditional bank run by depositors. In Bavaria, depositors are depositing cash in safety deposit boxes rather than banks. The depositor bank run in Bavaria, apparently does not worry Visco; but if this becomes contagious throughout Germany and beyond he will be forced to change his mind.

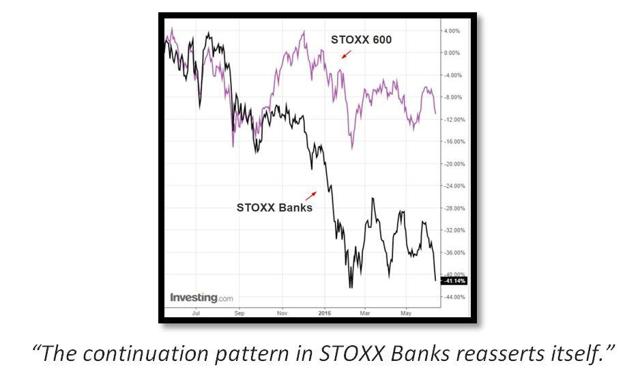

(Source: The Daily Shot)

European banks shares have belatedly re-correlated with the deteriorating fundamental flows.

(Source: The Daily Shot)

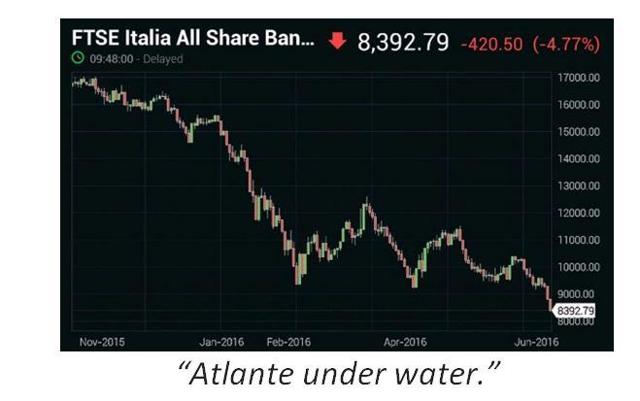

The situation in the Italian banking sector is even more perilous. The purported turnaround in the sector based on the "Atlante" private sector bank bailout fund is not happening. ECB Governing Council member Ewald Nowotny inadvertently signaled just how alarming the situation has become, with some ill-conceived and equally ill-timed comments on bank regulation. It is his opinion that the Eurozone banking system is at risk from over-regulation stifling the credit creation process. This is code for an admission that the banks are on the verge of insolvency because they cannot meet current capital adequacy rules.

Francois Villeroy de Galhau then used the same code, when he criticised the Bank for International Settlements (BIS) for attempting to impose even tighter capital adequacy rules on what he termed the "virtuous" national regulators. His issue is that Basel III, which is currently being applied, in fact tightens existing capital adequacy rules; which he believes is in contradiction to its undertaking not to do so.

(Source: The Daily Shot)

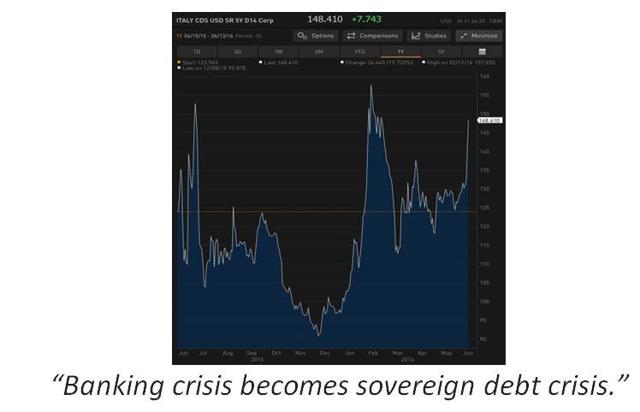

The evolving banking crisis is therefore becoming a sovereign debt crisis; as bank investors and depositors, having fled the bulge bracket Eurozone banks, are now looking to their national governments to support their domestic banks.

(Source: Bloomberg)

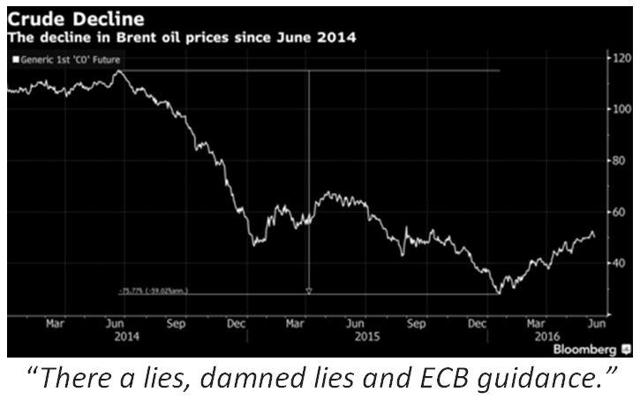

A greater reality check may be coming for those ECB members, noted in the last report, who have used the recovery in the oil price and its alleged second round inflation effects as signs that the last round of QE is working. Funnily enough, this reality check comes from within the ECB itself. In its latest bulletin, the ECB finds that the fall in oil prices from 2014 was mainly based on oversupply. The weak oil demand translated into a low elasticity of demand, which reflects an inherent level of economic weakness that the low oil price could not stimulate. In addition, the growth shock blowback in the oil producing nations acted as a net global headwind.

"Assuming that, for example, 60 percent of the oil price decline since mid-2014 has been supply driven and the remainder demand driven, the models suggest that the combined impact of these two shocks on world activity would be close to zero, or even slightly negative," the ECB report opined. Having used the rising oil price narrative as a convenient artifact, to support the on-hold watching the last QE stimulus work thesis, the ECB is swiftly changing gears for a future monetary expansion by providing the necessary intellectual collateral for the policy change.

(Source: The Daily Shot)

Eurozone's Mr Market is having nothing to do with the ECB speakers' positive framing of the inflation outcome from the current phase of easing. He seems to be confirming the reality check implied in the recent ECB report. Inflation expectations implied by swap rates just took a further leg down to a new record low.

Despite the ECB's current on-hold waiting for the benefit of the current easing programme to occur default position, it should be noted that the core of the Eurozone is not signaling any belief that this future benefit will occur. The Bundesbank and Bank of France, did not follow the ECB in revising upwards inflation and growth estimates. The Bundesbank cut its growth estimate from 1.7% to 1.4% in 2017, after a previous downgrade from 1.8% to 1.7%. The conclusion is that the slowdown in Germany is accelerating. The Bank of France cut its forecast slightly to 1.5% from 1.6% in 2017. The economic rebound from the current ECB stimulus therefore seems to be sadly lacking in the core, whilst Southern Europe flirts with a banking crisis.

(Source: Bloomberg)

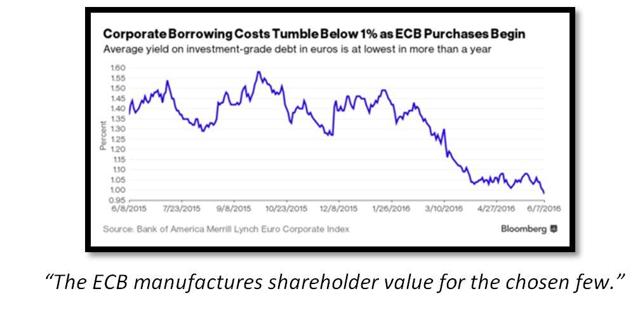

The easing process, the outcome of which the ECB speakers await, continued to unfold with a bang; as the ECB made its first noisy corporate bond purchases. The purchase of junk debt from Telecom Italia, was a particularly noisy event, given that it only just qualifies as investment grade courtesy of Fitch.

The immediate impact was the driving of yields below 1%. Had it not been for Janet Yellen's equally noisy backtracking on the pace of FOMC rate hikes, the Euro would have noisily lurched lower too. Instead the Euro strengthened, confounding the ECB's hopes for an immediate boost to the real economy of the Eurozone.

It now remains to be seen if corporations will use the lower borrowing costs to expand business activity, or simply to refinance existing debts and boost balance sheet liquidity. Faced with the Brexit and an economic slowdown, it is highly likely that they will deleverage and refinance. The positive impact on equity valuations, from the drop in corporate bond yields, provides no commercial incentive for corporations to do anything to drive their own company valuations through the earnings top line. The ECB is pushing on a string again and rewarding companies and their shareholders for doing nothing commercial.

Jean-Claude Juncker's bombshell admission that French fiscal transgressions go unpunished simply because it is "France" was swiftly addressed by Eurogroup President Jeroen Dijsselbloem. Such a slip of the tongue is just what triggers the Brexit and undermines the EU. It also infuriates the populists who do not live in France. He criticized Juncker's stance and warned that the Commission's continuous turning of a blind eye to "deficit sinners", would then lead to a "blind monetary union." This characterization of the outcome neatly describes the process that the European Union is currently undergoing as it lurches towards deeper fiscal and banking union. Dijsselbloem's words are good for openers, however it remains to be seen if he will be able to walk the walk that goes with them.

The granting of Prime Minister Rajoy an extension to his deficit cutting breathing room, during his re-election campaign, also came under the microscope from European Commission (NYSE:EC) lawyers. Not only was this act a dubious political decision taken to support Rajoy, but the lawyers also found it to be illegal. Yet another own goal was therefore scored in the game of Eurocrats versus Brexiteers and populists. Despite this smoking gun, no action has been taken against the EU or Spain. Once again no EU policy maker is walking the walk, because this walk leads to Eurozone breakup.

The Renzi government received a massive setback when Virginia Raggi the Eurosceptic Five Star candidate won the first round of the Rome mayoral election; and the party outperformed in local government elections. This cloud may have a silver lining for Prime Minister Renzi however. Fear of Five Star in Brussels is greater than fear of Italy breaking its fiscal guidelines. Renzi may therefore be the recipient of the kind of treatment, legal or otherwise, afforded to Prime Minister Rajoy when it comes to fiscal wiggle room.

In the last report, Italian ECB Governing Council member Ignazio Visco was observed making an obtuse attempt to push back against bank capital adequacy rules. Applying his circuitous logic, the current post-crisis legislation insulates taxpayers from any future banking sector bailout. The risk is therefore allegedly concentrated within the banking sector; which then responds by cutting back the availability of capital expensive credit. Visco advocates loosening capital adequacy rules; which will have the immediate impact of making the banking sector (especially in Italy) look liquid and solvent again.

Elke Koenig, the head of the banks' Single Resolution Board (SRB) wasted little time disabusing Visco of his view. According to her: "To put the entire system into question would ... take away the safeguard and not add to stability," ; and specifically in response to whether the bail-in rules would make the possibility of contagion in a country more likely, she said: "No, I don't think that that is true."

Thus far, capital adequacy rules will remain unchanged under the SRB's regime. Visco may therefore end up being right but for the wrong reason. Credit availability will collapse because banks will fail! Koenig's opinion and this suggested unintended outcome also lend support to the view developed in the last report that a period of bank consolidation is underway in the Eurozone.

The last report suggested that the summer recess will be a period during which EU policy makers perfect their schemes for greater political and economic integration, despite the opposing forces during the "Summer of Discontent". Handelsblatt recently reported that the scheme for a Eurozone bank deposit insurance scheme is currently under rapid construction. Allegedly, this European Deposit Insurance Scheme (EDIS) will be driven through the European Union's Economic and Financial Affairs Council (Ecofin) by Eurogroup chair Jeroen Dijsselbloem despite German opposition. Dijsselbloem confirmedthat his target for EDIS is 2024; which fell well short of the desires of many of the Ecofin members. Evidently, policy makers are aware of the banking run discussed above and are swiftly moving to address it with Eurozone taxpayer funds.

What Dijsselbloem had to say about the Growth and Stability Pact rules interpretation by the EU and the risk of the Brexit, was also of great interest. On the issue of "France is France" he was less than impressed and said that the rules should be strictly applied to all nations. On the issue of the Brexit he was very sanguine and left the door wide open for Britain to join again.The only way that Britain would conceivably re-apply is if the EU gets its act together and reforms. The discretion allowed to France is clearly synonymous with the kind of rule bending that is driving Britain out of the EU. It is therefore reasonable to conclude that Dijsselbloem will use the Brexit as a catalyst for reformation of the Eurozone, in order to prevent it from breaking up.

The reformation thesis will get tested in vivo in France. The unions are in the streets resisting economic reform, whilst Prime Minister Valls signals that there is no turning back. Now that Mr. Juncker has put France in the spotlight for rule-bending and Mr Dijsselbloem has cried foul, French policy makers have no room for maneuver at the EU level. They must now apply reform at the national level. If they are successful, this will be the key signal in support of the reformation thesis.

Undaunted from the potential for a banking crisis and dissolution of the European Union ((EU)) triggered by the Brexit, the European Stability Mechanism's (ESM) director Klaus Regling prepared for the next stages of deeper fiscal and political union. First and foremost, banking union must be achieved in his view. Following from this priority, a European Treaty change is envisaged, after which a new institution will become responsible for banking regulation. Critics of the ECB, from the core nations, are therefore being seduced into accepting deeper economic union with the idea that the ECB will have less control over the banking system.

The greatest reality check by far for the Eurozone would come from the Brexit. Based on recent polls, the probability of this event has now risen beyond the stay in vote. Faced with this disruptive shock, the ECB and the Bank of England did something counter-intuitive. Having opined the worst case scenario to frighten British voters into voting to stay in, the Bank then joined hands with the ECB to provide the respective Carney and Draghi Puts in the event of a Brexit vote. These puts will come in the form of swap lines which will guarantee unlimited liquidity in the event of the Brexit.

The first observation is that the Brexit has just been heralded as a massive monetary easing event by both the ECB and the Bank of England. Far from tightening global liquidity, the Brexit will actually "unlimitedly" expand it. One should therefore buy the Brexit fallout dip, even if one was not aggressive enough to sell the rumor going into the vote.

Secondly, the two central banks through their unconditional guarantees have emboldened those in Britain who were too frightened of the economic consequences for themselves to vote Brexit to think about it seriously. The Carney and Draghi Put will now convince them that they can ditch the EU and also reap the benefits of monetary policy shock and awe when it happens. The ECB and Bank of England are therefore unwittingly complicit in enabling the Brexit; and signaling their intentions and capabilities to do so in advance of the vote. Potential Brexit voters have now been given ten days to get comfortable with the outcome, rather than being frightened and bullied into voting to stay in right up until the last minute.

Every cloud has a silver lining. Evidently the Bank of England and ECB are looking into the positive monetary boost that the exogenous shock of the Brexit will create. This shock may also be the catalyst that Eurozone policy makers use for their political reformation, in order to prolong their own survival.

The published outcome of the Eurogroup emergency Brexit meeting, at the end of the week when it was suddenly realised that the Brexit's had it, may also have contributed to the British drive to leave. Jeroen Dijsselbloem stated that the Eurozone could handle the Brexit after the emergency meeting. It was all that he could say under the circumstances, however it will have convinced some British voters that if the Eurozone can survive then so can they.

The published outcome of the Eurogroup emergency Brexit meeting, at the end of the week when it was suddenly realised that the Brexit's had it, may also have contributed to the British drive to leave. After the emergency meeting, Jeroen Dijsselbloem stated that the Eurozone could handle the Brexit. Perhaps it was all that he could say under the circumstances, however it will have convinced some British voters that if the Eurozone can survive after the Brexit then so can they. The Doomsday scenario, of a mutually destroyed Britain and Europe post Brexit, would have been a much more powerful influence to stay in.

The IMF's "neutral" analysis and Christine Lagarde's attempt at "neutral" commentary, did little to help the Stay Ins. Whilst predicting recession and falling incomes for the Brexit outcome, Lagarde then said that the Eurozone was itself on the brink of collapse. This was almost the perfect Doomsday scenario but not quite; since she did not directly connect the Eurozone's fate with that of Briatin. Faced with recession on its own ,or an economic collapse of the Eurozone that will come at great cost to Britain European Union membership, the British pain avoider will logically vote Brexit.

The reaction of French Economy and Finance Minister Macron, to the heightened Brexit threat, was the most telling in relation to the reformation thesis. Macron is launching an alternative vision of reform in France; to challenge the status quo and ultimately President Hollande. He has now capitalised on the Brexit crisis to promote his vision and himself. In his opinion, the Brexit will spell the end of the perfidious Albion and its ultra free market influence in the EU.

The reaction of French Economy and Finance Minister Macron, to the heightened Brexit threat, was the most telling in relation to the reformation thesis. Macron is launching an alternative vision of reform in France; to challenge the status quo and ultimately President Hollande. He has now capitalised on the Brexit crisis to promote his vision and himself. In his opinion, the Brexit will spell the end of the perfidious Albion and its ultra free market influence in the EU.

He framed the UK referendum as purely a referendum on immigration, thus showing that the EU is not just about abolishing borders but rather about establishing appropriate rules and regulations. If and when Britain leaves, France will immediately launch its vision of the EU's future. Despite Macron's enthusiasm for reform of the French economy, the vision he implies for the EU is the Socialist panacea that has thus far eluded both France and the Eurozone; and turned a significant number of Britons in favor of the Brexit. Macron wishes to re-form the EU rather than to reform it. The distinction is profound.

As Jean-Claude Juncker pivoted the EU towards Russia, in his latest strategic dialogues with President Putin, the Trans-Atlantic interest in the EU came to the fore. This strategic interest is arguably more powerful than all the other forces involved. Juncker has shown himself to be in favor of a European Army. The Obama administration has finally delivered its verdict, that such a European Army is in fact not desirable because it undermines NATO. The verdict may have been heavily influenced by a realization that the Brexit now is the highest probability outcome. Having talked in favor of Britain remaining in the EU, America has gone silent.

This verdict was delivered in code, by the tactical switch from Stay In to Leave of Lord Guthrie of Craigiebank former British Chief of Defence Staff. Lord Guthrie opined that his decision was based on a long-standing British commitment never to engage in a European Army; however this does not fully explain his original positioning and sudden late switch. Based on his explanation, he should always have been a Leaver, so something recently must have changed his view.

The latest insight into Trans-Atlantic thinking, based on reports from Canadian intelligence is that Russia is preparing for war. Juncker's moves towards Russia clearly evince an attempt, to anticipate further hostilities on European soil, with a defined EU peace initiative. The EU is however at odds with NATO and NATO is the global national security umbrella for the West. The elevation of Europe to parity with NATO is something that will not sit well in Washington and other capitals outside of Europe. Thus having previously argued for Britain to remain to defend NATO interest in the EU, America has changed its mind in light of new developments. NATO may therefore have its own reformation process in mind for the EU. This may require destruction of the old EU in order to create the new one.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)