The thing Wall Street hates most is uncertainty. In today's economic reality, neither earnings declines nor bad economic data wreaks the sort of stock-market havoc that uncertainty does. With S&P 500 (NYSEARCA:SPY) earnings at three-year lows, one might think that broad-market indices would be trading well off their all-time highs. But in a reality in which investors cheer earnings declines and dreadful economic data because it means more easy-money from central banks, the Dow Jones Industrial Average (NYSEARCA:DIA) and S&P 500 are defying gravity and trading just a few percentage points below their all-time highs.

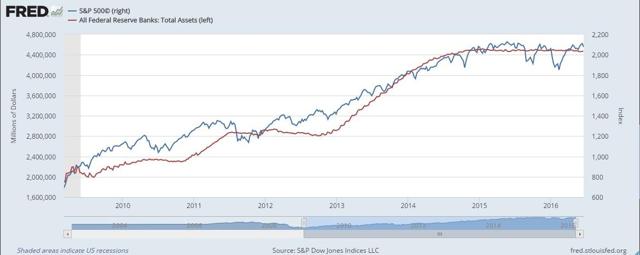

Broadly speaking, investors don't seem to care that earnings are falling, that the S&P 500 has a P/E over 20 (based on Q2 2016 estimates), or that economic data leaves much to be desired. Instead, investors only care about one thing. Yes, there is only one thing that has mattered to investors throughout the most recent bull market, something illustrated in the chart that follows.

As the chart above clearly shows, since stocks bottomed on March 6, 2009, there is a directional correlation between the level of assets held by the Fed and the price level of the S&P 500 that is uncanny. The only thing that mattered for nearly seven years was whether the Fed was expanding its balance sheet or whether the Fed intended to expand its balance sheet.

Once the Fed stopped increasing its assets, stock-market indices struggled to continue moving higher, instead shifting focus to whether the Fed would tighten, by how much it would raise rates, and how quickly it would do so. Not surprisingly, the first Fed rate hike was followed by a serious market-wide selloff which ended as Janet Yellen was testifying before Congress and discussing things such as negative rates being on the table and there "always" being some chance of recession "in any year."

I know some market participants will point to oil (NYSEARCA:USO) bottoming as the reason stocks bottomed in February 2016. The truth is, if you examine the oil futures curve, it's clear oil's effective bottom occurred on January 20. For example, every single remaining 2016 contract (July, August, September, October, November, and December) bottomed on January 20. The same is true for the most actively traded 2017 and 2018 contracts (March, June, and December 2017, and June and December 2018). The reason USO made a bottom on February 11 rather than January 20 likely had more to do with the massive contango that existed at the front end of the oil futures curve than it did with the positioning of traders. Ultimately, it was Yellen's Congressional testimony that started the massive rally in asset prices as market participants first came to collectively understand the Fed is trapped and would have to forgo hiking for the foreseeable future.

If the global economy is too weak to handle another Fed rate hike, and we know that market participants are happy with that, what could possibly cause stocks to fall from here? If we are to operate under the assumption the Fed is done hiking and that traditional fundamental analysis is now irrelevant to stock-market investors, then we are left looking for black swan types of catalysts as triggers for a serious bear market.

Yes, it would be easy to think of all sorts of outlandish things that could happen and cause a precipitous fall in stocks. I could also focus on risks that are already with us now; risks that investors are choosing to ignore. These include outrageous private market valuations for commercial real estate and startups as well as a negative interest-rate regime that will slowly bleed the European banking system to death. But those risks belong in the realm of fundamentals, and in today's world, investors believe central banks will backstop any potential fundamentals-related issues that pop up.

Instead, for the purposes of this article, I would like to focus on three near-term catalysts that are not being priced into markets, are well within the realm of possibility, and would cause a devastating fall in stocks because of theextreme uncertainty they would cause. Even though central banks have proven skilled at bailing out virtually anything that needs to be bailed out, it's hard to bail out something if you don't know what needs to be bailed out. It is uncertainty related to serious events that can cause tremendous market disruptions. Therefore, if only for the purposes are staying aware, readers should consider the following three risks to their money:

Black Swan #1

On Thursday of this week, the United Kingdom will have a vote on whether to remain in the European Union. While the upcoming vote has been widely known for quite some time, judging by where asset prices stand today, it is quite evident market participants believe the vote will be to "Remain" in the EU. Should the vote be to "Leave" the EU, all hell is likely to break loose in financial markets.

If the UK were to leave the EU, not only would that destroy investor confidence in the long-term viability of the EU (would a NEXIT be next?) but it would also pose very real-life challenges for the world's fifth largest economy, not least of which concerns the financial sector. In the event of a "Leave" victory, it would take a couple of years to put all the necessary agreements in place for a new ongoing relationship with the EU and for the UK to officially withdrawal from the union. In the meantime, investors are unlikely to wait to find out whether things will work out.

It wouldn't be surprising to see a huge selloff in financials and a massive drop in the British pound should UK citizens vote to leave the EU. I would expect the selloff not to be contained to UK financials but instead to spread throughout many of the global SIFI banks. The global financial system is extremely interconnected and doesn't like changes to the status quo. Should any serious uncertainty surface as to the long-term viability of the European Union, major banks such as Deutsche Bank (NYSE:DB), Credit Suisse (NYSE:CS), and Barclays (NYSE:BCS) will continue to come under intense scrutiny (take a look at their stock performances over the past year or so). As those banks come under scrutiny, investors will likewise sell other global financial institutions such as Citigroup (NYSE:C), Bank of America (NYSE:BAC), and JPMorgan Chase (NYSE:JPM) on the mere threat of contagion. An interconnected global financial system will need serious central bank intervention to contain the repercussions of a BREXIT.

Investors would be hard-pressed to imagine a scenario in which broad-market equity indices are able to shake off serious concerns in the global financial system. It is the threat to the UK and European financial systems resulting from a BREXIT that would bring about a potentially massive drop in stock prices. Professional investors understand that the world's massive financial institutions depend on short-term funding to stay alive. As everyone learned in 2008, the moment counterparties doubt the creditworthiness of an institution, short-term funding either becomes a lot more expensive or disappears entirely. And it can happen quickly. I would assume the Bank of England and ECB are already planning for how to support short-term funding markets in the event of a BREXIT. Should the people of the UK vote to "Leave" on Thursday, we will soon find out just how prepared the central banks are.

Black Swan #2

Perhaps the most underrated investment concern with the highest probability of a negative outcome is localized Zika transmission by mosquitoes in the United States.

For those unfamiliar with Zika, it is a virus mostly spread through the bite of an infected Aedes mosquito. People who actually show symptoms (most do not) usually only experience mild fever, rashes/red eyes, and joint pain. Most people never end up in the hospital as a result of Zika. So what's the big deal?

The big deal is that Zika apparently causes microcephaly and other birth defects in babies, while the babies are still in the womb. The thinking is that the virus crosses the placenta and attacks fetal nerve cells resulting in babies with abnormally small heads and other potential problems (learn more about microcephaly here).

How is Zika transmitted? As mentioned above, the most common way Zika is transmitted is from the bite of an infected Aedes species mosquito. These mosquitoes become infected by feeding on Zika-infected blood. Therefore, once someone brings Zika back to the United States after contracting it elsewhere, and that person is bit by an Aedes mosquito, the virus could spread quite quickly.

Zika is also spread via semen. It is known that Zika can live in semen longer than it can in blood, but it is not known exactly how long Zika can live in semen. Therefore, Zika can also be spread through sex.

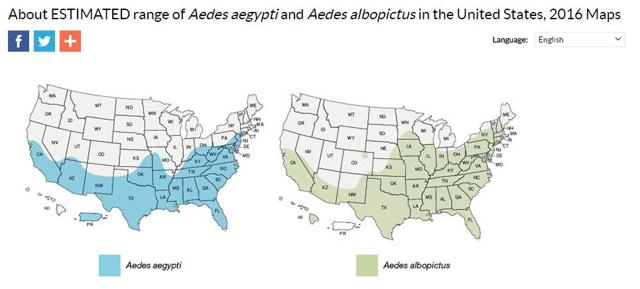

Where in the United States could the Aedes mosquito potentially be found? The Center for Disease Control and Prevention has provided the following maps of the estimated range of the two Aedes mosquitoes that can carry Zika. As you will notice, the range covers large sections of the United States.

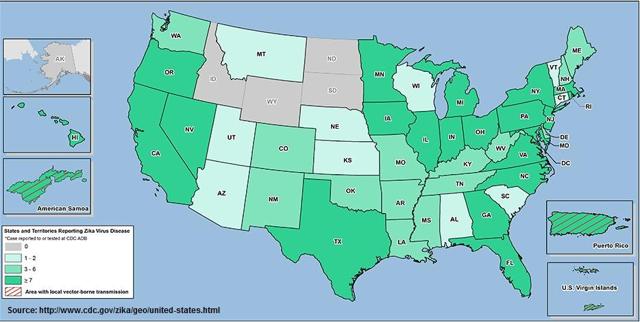

With Zika-infected mosquitoes literally on the doorstep of the United States, it's only a matter of time before somebody brings the virus into the countryand is bit by an Aedes mosquito. As of June 15, 2016, there were 755 travel-associated cases of Zika reported in the U.S. across 45 of the 50 states (see map below).

With the mosquito season just heading into full swing, it will not be a surprise to see the first U.S. mosquito-associated cases of Zika spread later this summer, especially after thousands of people return from the Olympics in Zika-infested Rio de Janeiro.

If neither you nor your loved ones are planning to get pregnant any time soon, why should you care about Zika? First, the fact that Zika poses no risk at all to most people is what makes the virus so concerning. There are tens of millions of Americans who simply won't care if they get infected, thereby increasing the risk to millions of others who do care. This is very different from other diseases that pose serious threats to everyone. In those cases, everyone gets on board to stop the disease. In this case, there will be millions of Americans who will go about their daily business not thinking about the fact that they could be the ones to pass along Zika to a mosquito that will then pass it along to a pregnant woman.

In 2014, there were 3,988,076 births in the United States. Preliminary data for 2015 shows 3,977,745 births. Let's assume Zika, should it reach the United States in earnest, puts roughly 4 million women at risk every year. Think about not only the potential effects to the economy from tourism plummeting in the Gulf region or up and down the east coast and southern California beach towns should Zika become widespread in the U.S., but also the effects on various companies' revenues should women decide to delay or forgo getting pregnant. Johnson & Johnson (NYSE:JNJ), Kimberly-Clark (NYSE:KMB), and Procter & Gamble (NYSE:PG) are just three of many companies that would likely take a hit from a widespread outbreak of Zika in the United States that results in a declining birth rate from women who planned to get pregnant but then changed their minds. If Zika became a multi-year issue in the United States, it could eventually have longer-term effects on school systems, day cares, sales of certain types of cars (mini-vans for example), toy sales, health care spending, and a whole host of other things that are likely not coming to mind as I type this.

The bottom line is that Zika-infected mosquitoes arriving in the United States later this summer, at a time when no vaccine is available, will cause massive uncertainty and undoubtedly have a huge downward impact on stock prices as investors try to handicap the future impact to the economy. Yes, the Fed may eventually step in. But in the case of Zika, it's a big enough issue that I think investors will sell first and ask questions later.

Black Swan #3

It seems as if Americans, as a collective group, couldn't be more divided on countless issues. But there's one thing most Americans have in common; something that sets the stage for this fall's black swan arrival. What do countless Americans have in common in today's age of high profile polarizing issues? Put simply: a very high level of dissatisfaction.

Why are Americans so dissatisfied? Between the sluggish economy and a political reality that leaves so much to be desired, it makes perfect sense that people are frustrated with the state of things in America. A recent Quinnipiac University poll showed, "a deep well of dissatisfaction among American voters who say the U.S. has lost its identity, that they are falling behind financially, that their beliefs and values are under attack and that public officials don't care what they think."

To those individuals who think the level of the Dow Jones Industrial Average or the unemployment rate are signs things are all peachy across America, I would counter by pointing to the Fed's own Labor Market Conditions Index, which is now in recessionary territory, falling corporate profits, and a Fed funds ratethat seven years into a supposed economic recovery is still at just 38 basis points. The historically low Fed funds rate alone is indicative of an economic reality that is quite unhealthy. Seven years into a supposed economic recovery, Fed funds should not still be at just 38 basis points.

Astute investors have come to recognize the role the Fed's easy money policies have had on stock prices in the post-crisis years (outlined in the introduction). In addition to the aforementioned, it's also important to note that a whopping 108.5 million Americans 16 years of age and older are either unemployed, underemployed, or not part of the labor force (add data from sources here andhere). Even when subtracting the roughly 51.5 million Americans that are 65 and older (46.2 million as of 2014 plus an average of 10,000 new 65-year-olds each day since 2014), that still leaves us with 57 million Americans of so-called working age that are not fully employed. That is a staggering number that needs to be repeated. There are roughly 57,000,000 Americans of working age that are either unemployed, underemployed, or not considered part of the labor force. With a working-age population of 204 million, it meansthe real un/underemployment rate among working-age adults is 27.94%. Surely, some of those people are retired. But I doubt tens of millions of them are.

Perhaps not surprisingly given the level of deep dissatisfaction among Americans, the Presidential primary season was dominated by the rise of Donald Trump and Bernie Sanders, both of whom ran campaigns that seemed to resonate with millions of voters. Despite the best efforts of mainstream media outlets and politicians to ensure that mainstream candidates ended up the major party nominees for President, the people spoke, and the United States nearly ended up with two outsiders as the nominees of the Democratic and Republican parties.

Even though Bernie Sanders is most unlikely to win the Democratic primary process (he'd need Clinton to be indicted), Americans do in fact have two outsiders running in the general election. Donald Trump is one, and the other is Gary Johnson, the nominee of a party that Americans should get to know, because it's likely going to become a major third party in the years to come.

Democracy and the Coming of a Third Major National Political Party

Given the long history of two major political parties dominating the American landscape, it will take a unique time in history for Americans to take a chance on a third option. Due to (1) the high level of dissatisfaction in the country, including high dissatisfaction with the two major-party candidates for President, and (2) the number of self-identified "Independents" standing at41%, this year will be the year that the process of adding a third major national political party gets underway. Even though it will take a few more election cycles to be considered mainstream, the Libertarian party is very likely going to disrupt the 2016 election in a way that will cause massive uncertainty in the fall. While Gary Johnson himself is not the black swan I am referring to, should he manage to make it to the debate stage with Clinton and Trump, Gary Johnson will prove such a powerful third choice for many dissatisfied Americans, that he will cause the arrival of a black swan in November.

Nobody Will Win the Electoral College

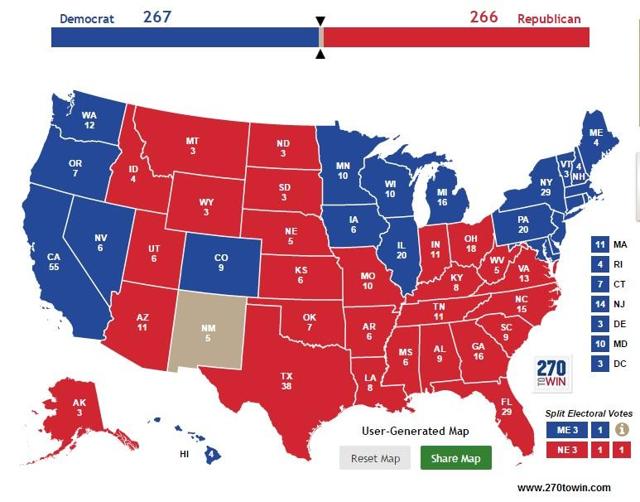

The black swan event that nobody will see coming until we're much closer to the election is the very real possibility that nobody will win the presidency on election night. Contrary to what many people may think, it will not take a huge electoral showing in the general election for Gary Johnson to prevent Trump or Clinton from winning the Electoral College. In fact, there are a few very realistic scenarios in which Johnson could spoil Trump's and Clinton's bids for Electoral College victory, one of which only requires Johnson to win New Mexico, a state that already elected him twice as Governor (he served as governor of New Mexico from 1995 to 2003).

Using the interactive map at www.270towin.com, I constructed the following electoral map, in which neither Clinton nor Trump win the general election.

A detailed account of why I chose Trump, Clinton, or Johnson for each of the 50 states is beyond the scope of this article. But if you take a hard look at the map above and do some homework on each of the states, you'll discover that this electoral map is well within the realm of possibility and well within the realm of probability. The most difficult thing to believe about this map is that Gary Johnson could win even one state. In 2012, he captured just 3.55% of the vote in New Mexico. Why would this year be any different? Quite simply: if Gary Johnson gets on the debate stage with Clinton and Trump, all bets are off. The presumptive nominees of the Democratic and Republican parties are so disliked by so many Americans that it's easy to imagine millions of people voting for the Libertarian simply because it's a vote they can feel good about. I think every day Americans are going to be pleasantly surprised when they learn there is a socially liberal, fiscally conservative candidate in the race for the White House (read about his stance on the issues here).

What are the odds Gary Johnson makes it to the debate stage? Quite high. According to The Commission on Presidential Debates, three things are required to qualify for the general election debates: (1) the candidate must be Constitutionally eligible, (2) the candidate must appear on enough state ballots to have a mathematical chance of winning the Electoral College, and (3) candidates must reach 15% of the national electorate "as determined by five selected national public opinion polling organizations, using the average of those organizations' most recently publicly-reported results at the time of the determination." The final determination will be made after Labor Day. In 2012, the CPD used the following polls: ABC News/The Washington Post, NBC News/The Wall Street Journal, CBS News/The New York Times, Fox News, and Gallup.

Gary Johnson, as the nominee for the Libertarian Party appears to be Constitutionally eligible, and he will be on enough state ballots to have a mathematical chance of winning the Presidency. In order to make it to the debate stage, it will all come down to Johnson's poll numbers. In the most recent CBS News and Fox News polls (two of the polls used in 2012), Johnson is at 11% and 12% respectively. To get to double-digits given how few people have actually heard of him, is, in my opinion, quite remarkable. And he still has plenty of time to get to 15%.

Remember this: If Johnson get to the debate stage, start planning for the unexpected in November. Should nobody secure enough Electoral College votes on election night, it's going to be a very long November and December for stocks. In case you're unfamiliar with what would happen next, if nobody wins on election night, the House of Representatives will decide who will become President. In fact, if you want to imagine a really big black swan event, there is a scenario in which neither Trump, Clinton, nor Johnson become President. After all, should nobody win the Electoral College, the Senate will choose the Vice-President; a Vice-President who will become President until the House chooses a President by a majority vote (with each state casting a single vote). Imagine if Trump's or Clinton's Vice-Presidential candidate ended up President of the United States (depends on how the Senate swings this fall) because a faction in the House decides to vote for Gary Johnson (and continues to do so in subsequent votes), ensuring that neither Clinton nor Trump becomes President.

Conclusion

I do not think investors should sit around worrying themselves to death about all the potential catalysts that might wreak havoc on their portfolios. I certainly do not. With that said, being aware of and spending a bit of time assessing the risks of black swan events that fall within the realm of possibility seems like a prudent undertaking.

The three black swan events mentioned in this article are things that very easily could cause dramatic moves in stocks over the next several months. In fact, later this week, we will already know whether BREXIT is something that can be taken off the list as the UK votes on June 23. Regardless of whether any of these events ultimately occur, I hope you enjoyed the exercise of thinking through various downside catalysts, and I wish you the best of luck in your investing endeavors in the months and years ahead.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long BAC, C, JPM, and JNJ bonds.

.jpg)