I have no intention of ever buying the SPDR S&P 500 Trust ETF (SPY). But before I get into the reasons why I will never own this ETF, below are some popular reasons why many will buy the SPY:

- Fast diversification across 500 stocks in various sectors and industry groups

- Very low gross expense ratio of 0.0945%

- Large-cap U.S. index full of blue chips

- Passive management

- Dividends

- Super liquidity

For many, it appears to be one-stop shopping that is simple, diversified and cost-effective. So why would I ever make the claim that I will never buy this ETF? And why should you care?

The answer is related to how the fund keeps the expense ratio down – bymarket-cap weighting the positions in the fund. Weighting by market-cap might seem logical - at first.

Market-Cap Weighting

Market capitalization is simply the price tag of outstanding shares times the share price.

- Shares x Price = Market Cap

Many funds prefer to use publicly available shares, or float, instead of outstanding shares – but the theory is the same. Cap-weighting does not factor in such things such as cash and debt.

A market-cap weighted index is pretty much like it sounds. Stocks with a larger market capitalization have a larger weighting in the fund. A stock with a market cap of $50 billion would have ten times the weight in a fund than a stock with a market cap of $5 billion.

Cap-weighting is popular since it keeps management costs down. Once the fund takes the initial positions, it mostly rebalances itself. Some argue that active management has not been proven to deliver additional net returns on average – so why even try? Just "go with the flow" at the cheapest possible cost – right? That is the impression I get from the following research paper, The Cost of Active Investing (2008, Kenneth French).

But market-cap weighting is not the panacea that some have been led to believe.

A Hidden Stock Picking Strategy

You may have invested in a fund with 500+ stocks because you don’t believe that fund managers are good at picking stocks. Therefore, you bought this highly diversified fund. But look at where your money is really going:

- Roughly 50% of the fund is invested in the biggest 10% of the index

- Roughly 1.3% of the fund is invested in the smallest 10% of the index

Call it what you will, but market-cap weighting is a low-cost method to pick stocks based on a single factor: size. The bottom 10% of this fund is almost irrelevant. Even if these small stocks double in price, this wouldn’t make much of a difference if the top 10% of the fund drops by 2-3%.

A market-cap weighted strategy does not offer the type of stock diversification that one would assume you would get with 500 stocks. You can be making some highly concentrated stock bets. But no worries – right? I mean, this fund is weighting towards the largest companies in the market - correct? Not necessarily.

Bigger Companies or More Expensive Stock?

Some investors prefer to invest in larger companies because these are more likely to weather any upcoming economic storms. Buying massive companies may lead to the inclusion of high-quality, blue-chip stocks. Even if our portfolio is heavily weighted towards fewer stocks, shouldn’t we be fine provided these stocks represent the largest and highest quality companies in the market?

But what does market-cap tell you? Just the price tag of the stock and not the size of the company.

Do you want a large company or an expensive stock? These two might be correlated in that bigger companies generally have more expensive stock, but that is not explicitly what is being measured in a market-cap weighted portfolio.

If you wanted to invest in the largest companies, and not just the most expensive stocks, you should probably consider a fund that is based on fundamental indexing. Fundamental indexing looks at the company’s economic footprint instead of how investors are valuing that company. Here is the difference:

Fundamental vs. Market-cap Weighting

A fundamental index attempts to measure the size of a company without consideration of market price. A fundamental index may look at such measures as the following:

- Revenue or sales

- Cash flow

- Book value

- Dividends

A company with a larger economic footprint is considered to be a larger company according to fundamental indexation. While both fundamental and market-cap weighting may look similar, they have differences. Consider this 2-stock portfolio: Facebook (FB) and Amazon (AMZN).

- Facebook has a market-cap of $512 billion and $33 billion in trailing 12-month revenue

- Amazon has a market-cap of $480 billion and $150 billion in trailing 12-month revenue

If we were to weight our positions according to current market value, we would hold very similar amounts of Facebook and Amazon.

If we were to weight our positions according to the economic footprint (in this instance I only consider total revenue for simplicity sake), our portfolio would be over 80% Amazon and less than 20% Facebook.

If you look at the Schwab Fundamental U.S. Large Company ETF (FNDX) you will see that Amazon gets a fundamental weighting of 0.18% in the portfolio vs. a market-cap weighting of 1.9% in the SPY. Facebook gets a fundamental weighting of 0.12% vs. a market-cap weighting of 1.8% in the SPY. Although the prices of Facebook and Amazon shares are sky-high and heavily weighted in the SPY, the economic footprints of these companies are much smaller than the market-cap suggests.

You can read more on how this works in the paper Fundamental Indexation (2003 Arnott, Hsu and Moore).

Neither Approach Considers Value

Am I suggesting that you should buy a fundamentally weighted portfolio? Not necessarily. While fundamental indexation looks at the size of the company without considering the price, the market-cap weighted index looks at the price without considering the size of the company. Neither approach considers value – the link between what you are buying and the price tag attached to it. Both approaches will have some unintended consequences.

Both methods might have you holding stocks which are overpriced since neither one looks to value. Some say that there is no way to know if a stock is overvalued or undervalued. That being said, it is more likely that a market-cap weighted portfolio will include an overvalued company than a fundamentally weighted one. Why is that?

Market-Cap Weighting and the Potential for Overvaluation

Weighting towards market-cap gives added exposure to expensive stocks. I am not saying that the most expensive stock is necessarily the most overvalued stock. But some researchers feel that there is a higher possibility of an overvalued stock being found in the expensive seats than in the cheap seats.

Imagine for a moment that we are talking about land and property.

A fundamentalist might look at how much the property can produce in terms of income from rentals, the size of the crop harvest or the value of the minerals below the ground.

A "market-cap investor" does not even look at the property. His concern is only with how much other buyers are willing to pay for it. If one property sells for $100K and the other for $5 million, he shows a preference for the $5 million property.

It is possible that in the event of a pricing bubble, the person who shows a preference for expensiveness could have more exposure to the bubble. The bubble could also occur in low-priced properties too. A property selling for $10K might only be worth $5K. And just because the price of something goes up, this does not necessarily mean it is becoming more overvalued. It is possible for the price of stock to double while the fundamental value increases four-fold. In this scenario, the stock has increased its value and becomes cheaper although prices are twice as high. Despite the two-sided argument, many researchers feel that a cap-weighted portfolio will have higher exposure to overpriced stocks than an equally-weighted or fundamentally weighted portfolio.

You can read more on this topic in the paper Cap-Weighted Portfolios are Sub-Optimal Portfolios (2006 Hsu).

Testing Valuation and Cap-Weighting

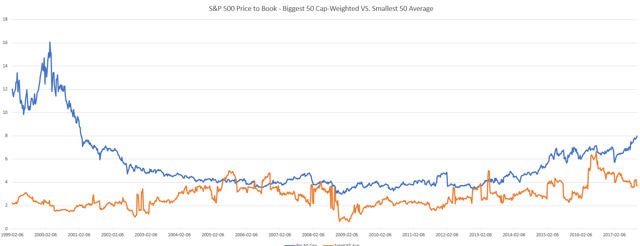

Despite the large amount of research already performed in this field, I felt that it was worth testing the difference in the price-to-book ratio (the most widely accepted value factor in academic research) between the 50 biggest and the 50 smallest stocks in the S&P 500. I added a further twist by cap-weightingthe price-to-book ratio of the 50 biggest stocks to further amplify the cap-weight effect and to compare this to the equal-weight price-to-book ratio of the 50 smallest stocks.

As you can see, cap-weighting skews heavily towards stocks with higher valuations. The average (equal-weight) price-to-book ratio of the smallest 50 stocks in the S&P 500 index is almost always less.

The lesson? A market-cap weighted index tilts away from value. Cap-weighting could inadvertently encourage paying too much for a stock - which leads to underperformance. I ran this test across the entire index (not just the top and bottom 50 stocks) and the conclusion is the same.

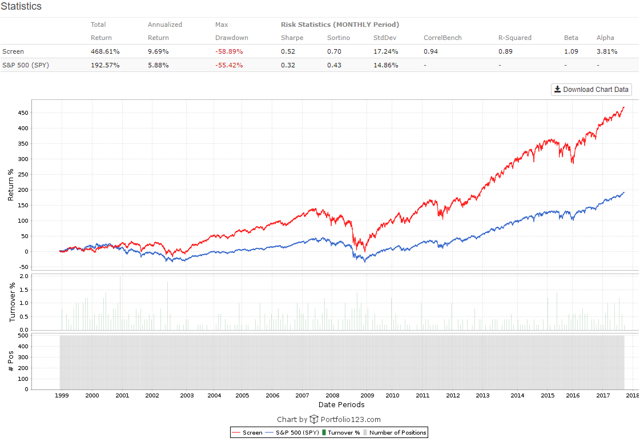

As for performance, below is a comparison between a simulation holding all 500 companies in the S&P 500 index equal-weight versus the market-cap weighted SPY. The long-term performance is almost 4% greater annually in the equal-weight category.

Is the underperformance of cap-weighting due to paying too much for the most expensive stocks, or is it due to the size and value factors outlined in this research paper A Five-Factor Asset Pricing Model (2014, Fama and French)? Does equal-weight deliver better returns with lower risk or are you getting a merely harvesting premium based on added risk? I'll let you be the judge on that one.

Other Potential Approaches Using ETFs

In short, I do not like the market-cap weighted approach used in the S&P 500 ETF because:

- Low diversification despite many stocks.

- Expensive stocks is not a perfect correlation to the most economically significant companies. Big cap is not the same as a big company.

- Market-cap weighting makes unintended bets on lower value stocks.

Besides investing in a market-cap weighted ETF, what are some other viable options? One approach is to buy an equal-weight fund. This should enhance diversification.

- Guggenheim S&P 500 Equal Weight ETF (RSP)

Even though this ETF attempts to equal-weight the positions, there is still going to be variance. You might notice that position weighting varies from 0.24% down to 0.05%. But the majority of stocks fall in the weight range of 0.18% to 0.22%.

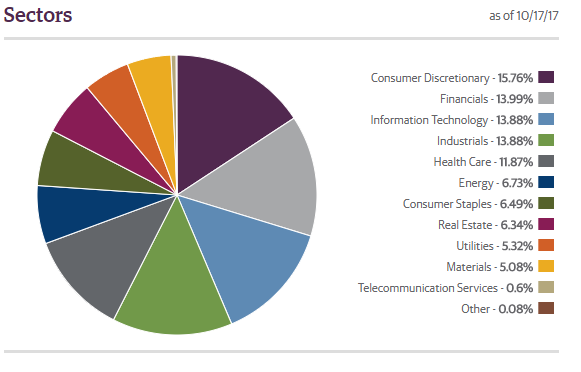

But perhaps you have a goal of having equal sector exposure. One look at the sector breakdown and you realize that your sector weighting is not equal with the above ETF.

If you want equal-weighting of sectors, this next approach might be right for you.

- ALPS Equal Sector Weight ETF (EQL)

This ETF is a blend of 10 other sector ETFs. Financials (XLF), Energy (XLE), Industrials (XLI), Materials (XLB), Tech (XLK), Consumer Discretionary (XLY), Healthcare (XLV), Real Estate (XLRE), Utilities (XLU), Consumer Staples (XLP).

While we optimized to hold the sectors equal-weight, we are now holding back to holding cap-weighted sector funds. Round and round we go. This next solution takes a little more work on your behalf, but it could be the purest solution yet.

- Buy all 10 Guggenheim Equal Weight Sector ETFs in Equal Amounts

You are targeting big stocks in the S&P 500, which you will hold equal-weight according to stock and sector.

|

Ticker |

Name |

|

(EWRE) |

Guggenheim S&P 500 Equal Weight Real Estate |

|

(RCD) |

Guggenheim S&P 500 Equal Weight Consumer Discretionary |

|

(RGI) |

Guggenheim S&P 500 Equal Weight Industrials |

|

(RHS) |

Guggenheim S&P 500 Equal Weight Consumer Staples |

|

(RTM) |

Guggenheim S&P 500 Equal Weight Materials |

|

(RYE) |

Guggenheim S&P 500 Equal Weight Energy |

|

(RYF) |

Guggenheim S&P 500 Equal Weight Financial |

|

(RYH) |

Guggenheim S&P 500 Equal Weight Healthcare |

|

(RYT) |

Guggenheim S&P 500 Equal Weight Technology |

|

(RYU) |

Guggenheim S&P 500 Equal Weight Utilities |

To my way of thinking, if you want to stick to larger-cap stocks, those found in the S&P 500, with even coverage across stocks and sectors – this is a good way to go. Sure, it takes a little more management as well as higher fees (0.40% as opposed to 0.10%), but I feel that it is worth it.

I am not saying that this approach is for everyone or that market-cap weighting is inherently bad. You might have a reason to own the SPY and are willing to take any unintentional factor tilts that go with it. Or maybe you want those factor tilts as you prefer expensive growth stocks trading with higher price momentum. Maybe you want to own the SPY because it is liquid and cheap and is better than some other alternatives. But this sort of investing is not for me, even if it comes at a slightly reduced upfront cost. I will not be owning shares of the market-cap weighted S&P 500 ETF anytime soon.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)