.png) Dr. Wealth 財富博士 Dr. Wealth 財富博士

The fact of the matter is that if you are going to buy and sell stocks, then it is mandatory that you also have a working knowledge of options, namely puts. Unfortunately there is just no way around it and it must be done. Whether one is a speculator or a conservative income investor, without a working knowledge and basic understanding of how put options work, you are putting yourself at great risk every time you invest your money. Many times I am presented with comments by investors who state that options are just too difficult and complicated, or they will use a blanket statement that options are too risky. When I press the subject, I find these same investors are usually oblivious to the basics of option trading and just won’t put the time into learning the subject matter. It is a sad truth with potentially dire consequence to follow. Currently there is no better example than the recent happenings with Dendreon (DNDN).

After the market closed on Aug. 3, DNDN released catastrophic news that it was withdrawing the company’s earnings forecast for the year and that second quarter results fell well short of Wall Street’s estimates. Dendreon said sales of its drug Provenge totaled $49.6 million in the second quarter as analysts were expecting $57.8 million in revenue on average. As a result, the shares fell 62 percent in aftermarket trading. To put that into perspective, Dendreon fell $22.38 to close at $13.46. Once the news hit, there was nothing that could be done for the retail investors holding shares or long calls. It is not known currently at what price DNDN will open or trade at on the following day. All that is known is that after the disastrous close, many retail investors were left completely shellshocked and distraught -- at least the ones who were not holding long puts before the close.

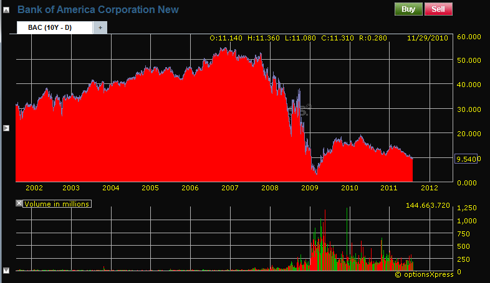

Before we get into the details of buying puts for protection, let’s take a look at some other stocks in relation to other types of investing. Prior to the financial crisis, Bank of America (BAC) was a blue chip, nice dividend-paying company. Conservative income investors and buy and hold investors would plow lots of hard-earned cash into this company’s stock. Now these types of investors are usually not option traders and will just grit their teeth and try to bear the pain as the price per share moves. The problem was that at the end of 2008 the wheels were going to come off and the entire market was going to crash, taking BAC with it. Many sold at dramatic losses as the pain became too much to bear, but several more just held on and took the ride all the way down for a death roll in the stock price. The question is, what if these people would have just had simple puts in place once it became evident there was a hint of trouble?

[Click all to enlarge]

Now let’s consider DryShips ( DRYS) as another example. DRYS is a major shipper in the dry bulk arena that is starting to dabble into the offshore deep water oil drilling business. Commodity bulls loved this stock and in 2007-08 the stock price was flying high as there were not enough ships to keep up with demand. Then along came the crash. A slowdown in global demand took its toll on DRYS and with too many ships in the market, the rates fell like a rock. Add to this several secondaries and you have all the ingredients of a disaster, and a disaster it was. Like BAC, many held on in hope of a miracle. That was what they'd been taught by the experts: Just buy and hold and everything will turn out all right. Sadly the experts and their advice were going to deal a real blow to some portfolios and cost some retail investors dearly. Once again, the question is, what if these people would have just had simple puts in place?

In these examples, all three stocks share the same characteristic in that they had massive selloffs. DNDN’s fall was after hours while BAC's and DRYS' were over an extended period of time. Oftentimes investors will state that a stop or a stop limit order would have been sufficient, but that is not the case. In our DNDN example, the dramatic plunge took place after hours, so when the market starts trading on the following day the stock price will probably open well below any stop price that was set. If left in place, the stop order will just execute on the next trade, which will be well below the amount the stop was set at making for a bad loss. A stop limit order would just go unfilled as the price will be too low for what the limit was set at. The stops would have worked on BAC and DRYS, but ultimately people just don’t put the orders in as they don’t want to miss out on the rebound. They think the bottom is close, only for the stock price to fall further down the hole, feeding into a vicious cycle. These are just some examples of the fate of some very famous stocks and companies. Every investor needs to take away the lesson that it can happen to her stock also, no matter what it might be. If the above is not reason enough to learn about puts, then nothing will convince you and you might as well stop reading at this point.

The Long Put

If an investor buys a put, she's basically paying for insurance, plain and simple. The buyer is paying the seller a set amount of money so that the seller will be obligated to buy a specific number shares at a future date for a specific (strike) price. That concept is simple and easy to understand. If on the expiration date the price of the stock is above the strike price where the put is sold, then the put expires worthless and the seller gets to keep 100% of the funds that you paid him and does not have to buy the stock. If on the expiration date the price of the stock is below the strike price where the put its sold (and the option is not closed out by you, the buyer), then the put will be exercised and the seller of the put will be getting your share at the agreed upon price. Of course, as the buyer of the put you can execute the contract at any time before expiration if you so choose. Examples follow.

Keryx (KERX) is a speculative biopharmaceutical company whose goal is to try to commercialize new pharmaceutical products that focus on renal disease and cancer. Keryx’s success lies in the form of two products that are being developed. The first is Perifosine, which is its oral anti-cancer drug, designed to treat advanced colorectal cancer; initial testing has delivered some very promising results. KERX’s second product, Zerenex, is an oral compound that is used to treat end stage renal disease.

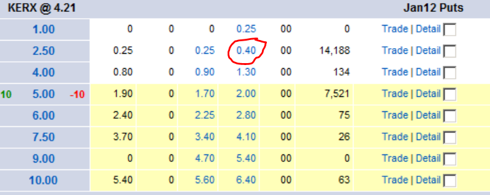

Let’s say you purchased 1,000 shares of KERX early on and paid $2 a share. You think that by January 2012 there will be big news that will move the stock price, but you are not sure if it will be positive or negative. The stock trades at $4.17 per share today, so you have a nice $2,170 profit built in at this point and don’t want to see it evaporate into a loss. So let’s look at the put option chain and buy some for protection. How much protection you want will depend on how much it is going to cost. Let’s buy the Jan 2012 $2.50 put for $0.40.

We will need 10 contracts as each contract is equal to 100 shares and we have 1,000 shares that need protection. It will cost us $400 (10 contracts =1,000shrs x $0.40) plus commissions. So let’s see some possible outcomes.

- KERX $10 on Jan 2012 – This is actually great news. Our 1,000 shares are now worth $10,000 but the $2.50 put we bought is worthless. We will lose our $400, but do we really care? No, the increase in the stock price more than made up for it. We are doing just fine.

- KERX $4.17 on Jan 2012 – No change in the price so we will still lose the $400, but for all that time we slept better knowing we had protection. Our paper profit of $2,170 has been reduced by our put expense ($400) though. Please note though that we expect something to happen by this time so the odds of no price change are a bit unrealistic.

- KERX $1.00 on Jan 2012 – This is why we have the put. We have had some bad event occur but our put comes to our rescue. Our total cost is $2,000 for the shares we originally bought (1,000 shrs x $2.00) and $400 for the put. At a share price of $1.00 on the expiration date, our stock is worth $1,000 but our put is worth $1,500 ($2.50 strike - $1.00 end stock price x 10 contracts). So with this total blowout, we would still make $100. ($1,000 stock price + $1,500 in puts= $2,500). Our total cost was only $2,400. Of course, commissions would have probably eaten the $100, but that is more than acceptable. Go ask the DNDN holders now if they wish they would have had a deal like this in place.

So we have seen KERX and heard about the DNDN disaster. The question is, what other stocks would one want to look at? The speculative biotech stocks are a logical choice, as they have specific upcoming dates that will have a major effect on the stock price.

BioSante Pharmaceuticals ( BPAX) is a pharmaceutical company focused on developing products for female sexual health and oncology. The lead product is going to be LibiGel, which is for the treatment of female sexual dysfunction. BioSante is conducting three Phase III LibiGel clinical studies and a new drug application is planned to be submitted to the FDA in 2012. Also, BioSante has Bio-T-Gel, which is a once-daily transdermal testosterone gel in development for the treatment of male low testosterone levels. The company has a PDUFA date of November 14, 2011.

Oncothyreon ( ONTY) is a biotechnology company dedicated to the development of oncology products for cancer patients. ONTY is focusing on the non-small cell lung cancer vaccine (Stimuvax) which is designed to stimulate an individual's immune system to recognize cancer cells and control the growth and spread in order to increase the survival rates.ONTY actually has a nice sized pipeline in relation to its size, but the success of Stimuvax will be the major catalyst for the company’s future. Needless to say, the upcoming results of Stimuvax will be the event for which one might want to get those puts in place.

There are many other stocks and ETFs where the long put can be used. This is only an introduction to help the investor learn how to shield her assets. As one starts investigating the world of puts, one will quickly see that they can become quite expensive. Insurance is not cheap, so one has to keep this in mind as one buys the puts. Buying the wrong puts can oftentimes eat up most of the profits, so one has to weigh the risk versus the rewards. Finally consider this: If our BAC or DRYS investors would have just gotten a few cheap out of the money puts, they could have avoided the dramatic losses and still kept some of their assets intact. It’s a hard lesson to learn, but one that must be learned.

In our next article, we will attempt to show an income investor how she also can use puts in conjunction with calls to secure income streams while protecting capital at the same time. |