Sometimes, I like to look at long-term charts for currencies, especially within the context of economic "moments of truth" that are rare even on a cyclical basis. An example of such, which has been receiving much attention lately, is the British pound (NYSEARCA:FXB) and Brexit referendum. Since its approval is thought to have far-reaching implications, snapshots of the British pound's (GBP/USD) 25, 50 and 100 year charts might add some perspective. If nothing else, perhaps one may find them interesting just for the sake of viewing or useful for evaluating the prospects of its underlying exchange traded fund.

The 25-year monthly chart below illustrates the formation of a head-and-shoulders pattern and impending convergence toward historical support at the neckline or 140-135 level. In technical analysis, this "chicken bones" pattern implies potential for further bearish price action. Considering that it didn't manifest itself overnight like some mysterious corn maze, but has been evolving over the space of two and a half decades, it might be deserving of a little head scratching as the British populace takes to the polls in 7 days to determine the outcome.

Should the pound break support at this all important neckline, it could theoretically see the day when it once more trades close to parity with the US Dollar. Wouldn't that be something? I haven't seen anything remotely close to this since my days studying abroad at Cambridge University (where I learned in a series of modern economic history lectures I attended that it was the British who actually won WW2, albeit judging from the historical depreciation of its currency one might argue otherwise). If you look at the chart below, it is clear to see that the pound has been in a secular downtrend for decades. To its credit, there has been consistent support for the pound near these current levels over the past 30 years or so.

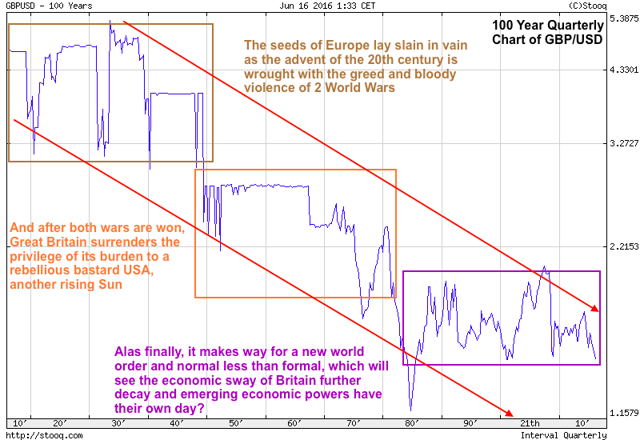

Finally, for an economic historical frame of reference, included is a 100 year chart of the GBP/USD. Some may not like history and/or choose to deny its patterned stages for civilizations and nations, but ignoring it tends to induce hubris intoxication. The world as we know or knew it has changed and is changing. However, its growing pains should not be mistaken for death throes. In the event that voters do favor a Brexit, the possibility of a sharp move downward in the British pound could be quite extended, but history has shown that such exaggerated moves in the market tend to correct themselves too. Only time will tell.

In conclusion, the tone of this post nor Brexit itself need not be interpreted as apocalyptic. After all, the standard of living in Britain and most developed nations has increased across the board. Simply put, while the UK's GDP is much larger now than it ever was 50 or 100 years ago, its percentage share of global GDP has diminished significantly. Nevertheless, its trading relationship with Europe (something I will be writing about in an ensuing report) is important enough that its exit is more of a problem for Europe than Britain and flexibly responding to it will be given the priority it deserves if or when it does. In the big picture, this too shall pass away.

Other related securities: US Dollar Bullish (NYSEARCA:UUP) and Euro Currency Trust (NYSEARCA:FXE)

Disclosure: I am/we are long EWU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am currently long the EWU and may consider a short position in the EUR/GBP forex market, in the event of a further decline in the value of the British Pound surrounding the Brexit referendum.

.jpg)