BREXIT. It's the current theme of conversation across most western economies at the moment. With the first (potential) politically motivated murder now having taken place, things are only set to flare up more.

For those of you who are out of the loop; UK is having a vote on 23rd of June to decide whether they leave the EU or not. As of writing this the Out campaign is in the lead, 53:47, but the outcome is not set in stone.

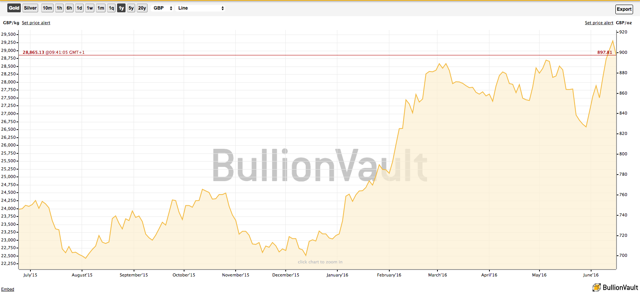

What is set in stone however is the paralyzing fear of uncertainty, investment flows are not occurring and the £ is falling fast:

(Source: LGBB Chart)

The chart above is of Bullish GBP vs. G10 Currency Basket (LGBB), it represents the £ vs. a broad range of other currencies. There is a very noticeable decline since November 2015 - this is the BREXIT effect! For those looking to trade the eventual recovery of the £ you should checkout (NYSEARCA:FXB) or (NYSEARCA:GBB), the prior has better liquidity.

Understandably, currency volatility has been through the roof, its currently approaching levels seen at the height of the last recession:

(Source: Bloomberg)

All this hardly provides a stable and reliable platform for business to take place on, the currency forms the basis of all operations in an economy. As a result, as previously mentioned, investment flows suffer.

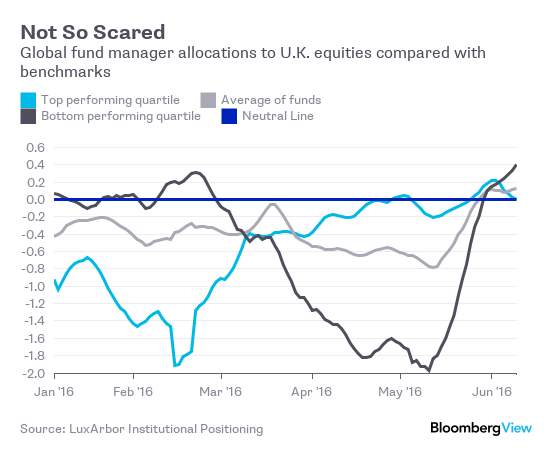

To give a more balanced view to this fear dialogue I thought I would highlight that it's not all gloom and doom:

(Source: Independent)

Allocations to UK equities has not seen the negative effect which the £ has experienced, no one is really running for cover here.

(Source: Independent)

In reality the net result of a lower £ should be a very positive thing for the UK economy once the fear subsides and outcome is made clear.

In the interim however we will see more volatility and pain in the markets, it was enough to throw off the FED - they didn't hike again. On top of this, bets on negative rates are on the rise again, see here for more.

For me there have been two assets which I already mentioned back in January as my top trades for 2016 they are effectively hedges for BREXIT!

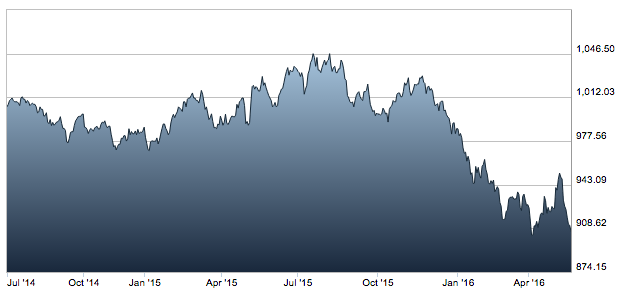

First let me introduce all that is golden and continues to shine:

(Source: BullionVault)

If you are misinformed to the extent that you do not own physical Gold within your portfolio, I seriously suggest you head on over to BullionVault and get an allocation to balance out your exposure. If you are happy to hold paper Gold then look at (NYSEARCA:GLD), but I must warn this is only 'as good as' until the day you get paid in dollars when there is physical market shortage.

There is a double-whammy effect in the above chart, not only is the £ devaluing against the USD but Gold is increasing in value against the USD. I have been telling people since the start of the year to park cash in Gold and keep enough aside to pay bills - no more.

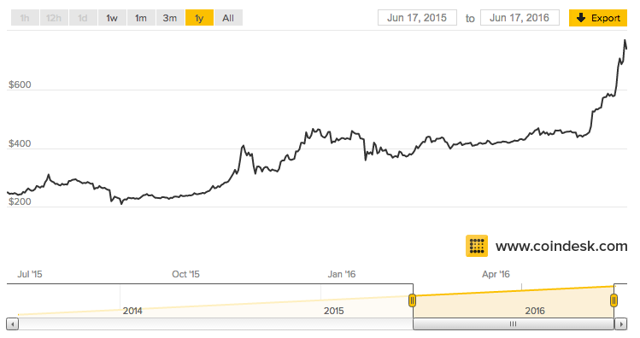

Second is a more volatile and digital coin, arguably I have more conceptual faith in a Bitcoin than a USD:

(Source: Coindesk)

Bitcoins are in the news at the moment with recent surges pushing the price up to over $750 per BTC!

They are totally virtual but present a watertight mathematical backing and a distributed ledger to complete the decentralised currency alternative. They are often used as a safe haven, as most noticeably seen in Greece and China.

The best way to get involved with BTC is by having your own digital wallet on a site like Coinbase. Again for those of you who are happy to have an indirect exposure there are two emerging ETFs just for this for you to check out; (NYSEARCA:ARKW) (Pending:COIN).

However you choose to structure your exposure over these turbulent times ensure you take a balanced and diversified view. Avoid punting on outcomes as the unexpected should always be expected. Timing trades is an absolute waste of time - you have to be faster, smarter or cheat - focus instead onrebalancing your exposure.

Follow me to get a notification on my upcoming piece on how to invest without having to strategically time the moves you make or track the news like a hawk. In reality, it can be done infrequently, purely by the beautiful simplicity of maths.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)