Natural gas futures prices posted their fourth consecutive weekly gain. The July futures contract for the week ending June 17th rose by 2.6%, closing at $2.623. From its low point in mid-March, futures prices have staged an amazing 55% gain, much of it in the past four weeks.

At the depths of prices in March, one article opined "This event has a better than even chance of happening this year. If it does, the result in terms of coming (LOW) natural gas prices can be historic." My responding article cited forecasts of a scorching hot weather in the summer to be followed by an early, bitter cold winter, which would reduce the storage glut and support prices.

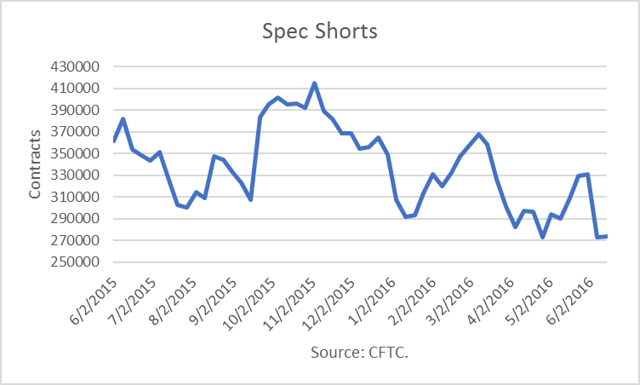

In early June, population-weighted cooling degree days (CDDs) have in fact been higher than normal. And now NOAA is predicting a hotter July than normal. As I noted in the last few weeks, spec shorts have been covering their shorts, causing prices to rally.

What's Next?

Utilizing the Commodity Futures Trading Commission (CFTC) Commitments of Traders (COT) reports for natural gas, I was able to assess what happened last week.

The four groups I follow - Hedgers (Producer/Merchant/Processor/User) Longs and Shorts, and Speculators (Money Managers) Longs and Shorts - are defined below:

Hedgers: A "producer/merchant/processor/user" is an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage or hedge risks associated with those activities.

Speculators: A "money manager," for the purpose of this report, is a registered commodity trading advisor (CTA), a registered commodity pool operator (CPO) or an unregistered fund identified by CFTC. These traders are engaged in managing and conducting organized futures trading on behalf of clients.

The latest data are for the week ending June 14th and include data for both options and futures combined for the New York Mercantile Exchange (NYMEX). All comments below pertain to each group as a whole, on balance, noting there are exceptions among individuals.

Findings

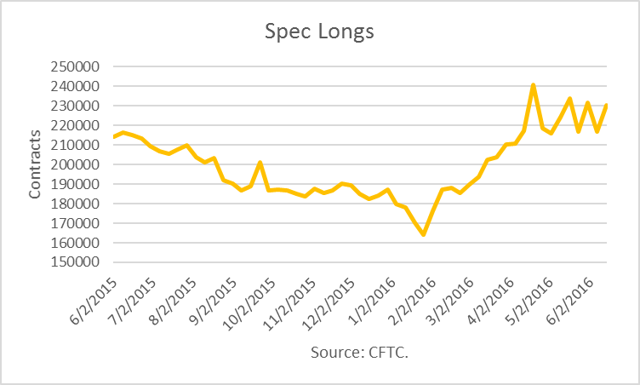

The Spec - Long group increased their position the most. They bought 13,731 contracts after prices have rebounded so strongly. This is money following a market, the opposite of smart money. In one blog I read yesterday, the writer proclaimed, "We are very bullish on prices for the next 12-18 months." When I read such words and see these increases in long positions, I see them as a warning that prices may have risen too far, too fast, and are ready to pull back to flush such buyers out of the market with losses.

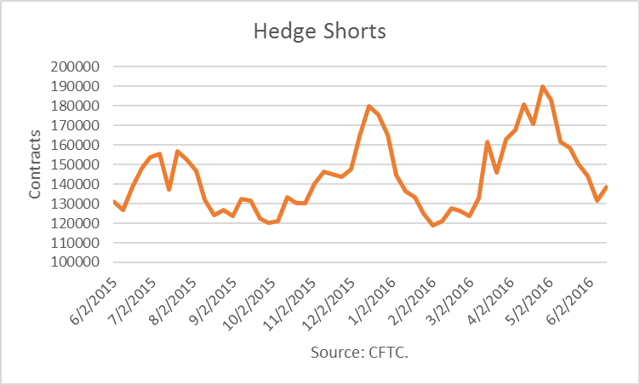

Short - Hedge operators increased their hedges (selling) by 6,921 contracts. They had 138,637 contracts in place. The had been buying back their hedges as prices broke higher. So this may signal a price point where they are willing to reset hedges, which could add a lot of selling resistance in the weeks ahead.

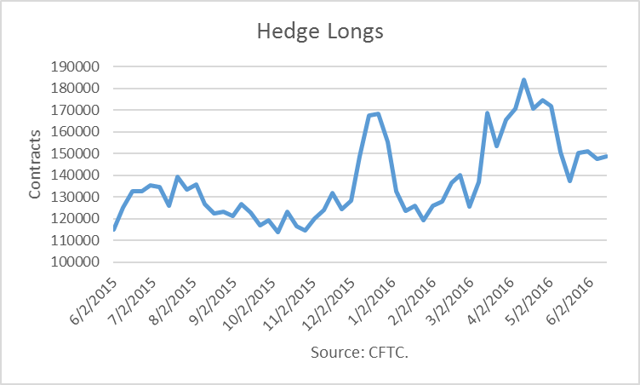

And Long-Hedge buyers on balance added 916 contracts. They ended the week at 148,579 contracts. The activity of the industry buyers contrasts with that of the money managers to add positions after such a price rise.

Finally, Spec-Shorts sold 529 contracts last week. Because their buying activity to get out of their shorts had propelled prices higher, it may be telling that this group feels more comfortable being short at these elevated prices.

Conclusions

The meteoric trajectory of natural gas prices was due to short speculators covering their bets (buying). But last week's data indicated a pause. My interpretation is that they are more comfortable being short at these levels so don't expect them to push harder without more proof than forecasts of heat.

On the contrary, last week's price rise was based on the entry of new spec buyers. Because they are johnny-come-latelies expecting higher prices, it makes me uncomfortable to be in the same company as them.

Lastly, it appears hedge sellers are taking an interest in increasing hedges. They could create more of a headwind should price advance further.

I can't say this is the top for now, but the risk-reward isn't as enticing to me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)