Gold started its rally during the third week of December 2016 in response to the correction in the four big markets that push gold around: Treasury rates, the dollar, the USD/JPY FOREX pair, and inflation. The rally in gold will stay in place as long as these markets continue to correct, but we think that these corrections are close to being done and the strong resistance at $1200-$1220 will mark the end of the bounce in gold and the resumption of the gold bear.

The dollar and Treasury rates, are correcting after a meteoric rise that started last summer, but we do not think that the upward bias has changed in these markets (chart below).

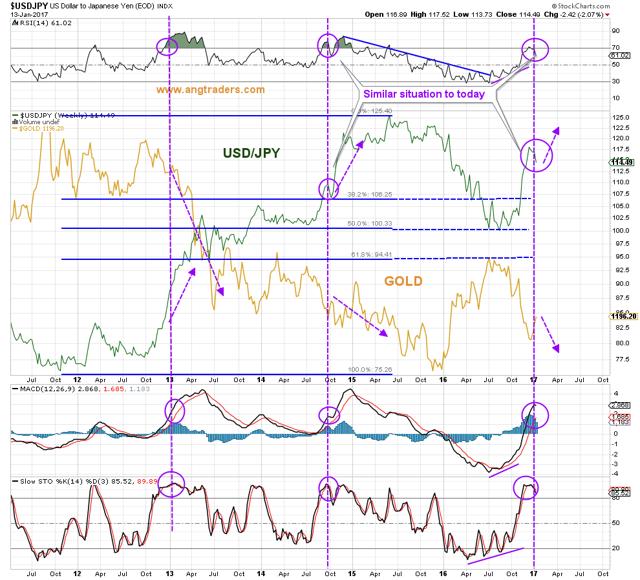

The USD/JPY ratio has taken a breather after a near-vertical rise, but the technical positioning is very similar to October 2014, which was only an interlude in the ratio's upward trend (chart below). The longer-term uptrend in the ratios remains in place.

Inflation acts as a bully that pushes gold around, and the Pring Inflation index, which is an independent measure of inflation that is not calculated by the government, shows that inflation is not out of control. The graph below shows how last year's gold rally was a result of the sharp increase in inflation, but that is not the present situation. Increasing rates will keep inflation in check, and as a result, gold will struggle.

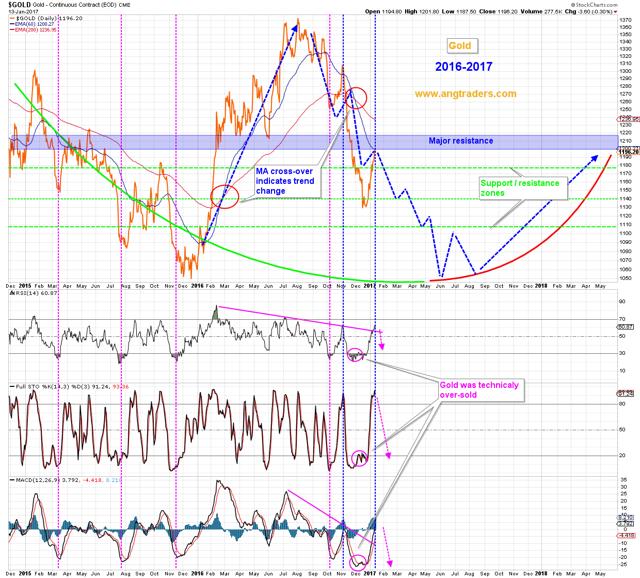

From a strictly technical perspective, gold was over-sold and its bounce in price is not unusual. The chart below shows that the rise in gold's price has over-extended the RSI, the Stochastic, and MACD which usually leads to a change in direction.

In conclusion, if the trends in Treasury rates, the dollar, the USD/JPY rates, and inflation change, then gold will break above $1220 and we will cover our gold shorts, but we think that the balance of probabilities favor gold returning to its downtrend.

Disclosure: I am/we are short GDXJ, JNUG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)