You've Accumulated $1 Million For Retirement: Time To Cash Out Your Chips?

Subscribers to "Retirement: One Dividend At A Time" got an early look at this material and receive instant text message trade alerts which often produce lower entry price points and higher yield and income.

Tuesday morning we saw the Dow Jones Industrial Index hitting yet another intraday record of 20,155. Long-term investors who have been at it a long time find their stock market-invested assets have appreciated more than 200% along with the general market since the Dow hit a 6517 low on March 9, 2009. This means that if they had around $333,000 at the market low and they stayed invested, their current stake would be about $1 million had they stayed the course and their portfolios tracked the general market. If your stock market assets are higher or lower, please feel free to extrapolate.

Sitting on one end of the table, this tripling of assets has some investors feeling good about their determination and decision to hold onto their high-quality stocks for the long term.

On the other side of the table today sits the investors growing more nervous by the day. Hitting records leads them to believe that it's only a matter of time till the next bear market is upon us. How long can the market continue in this bullish mode before it hits a wall and it all comes tumbling down, just like in 2007-2008?

Perhaps they initially had a goal of accumulating $2 million for retirement. Fearing that half a loaf is better than no loaf at all, they're thinking of cashing out now to fully protect the assets they now have. Protecting their $1 million retirement stake is better than seeing it all go to heck, or $480,000 which would mirror the 52% loss seen in the S&P 500 in the financial meltdown. How could they maintain their retirement spending on just a $480,000 asset base when their original goal was to accumulate $2 million? So, for them, perhaps half a loaf is indeed better than no loaf at all.

Pulling in their horns now would guarantee their current stake if they liquidated the entire portfolio. Protecting and preserving capital, is, after all, a noble goal, especially the closer one comes to retirement. What would you do?

What Would You Do?

John Quiñones hosts a popular T.V. showed called "What Would You Do?" A variant of Allen Funt's long-running "Smile, You're on Candid Camera," Quiñones' show tackles one moral dilemma after another, examining how different people handle the same social situation. The large variety of reactions reflects different social norms and creates tensions that keep you coming back for more to measure your own reactions. Everyone wants to know if their reaction would be considered normal when measured against others.

Let's examine some possible outcomes should we decide to stay invested or to cash out completely. Later, in the comment section, we'll get a chance to find out how normal we are.

Hold On To What We've Got - Cash Out

Many writers and pundits have advanced the stratagem that the closer one comes to retirement, the more thought should be given to cashing out one's stock market investments. The theory goes that if the retiree should suffer a large drawdown right at the beginning of retirement, it might take many years for the investor to get back to even.

While the market would be in sell mode, the new retiree risks having to sell more of his shares at fire-sale prices in order to fund his retirement expenses. Do this for too many years and the retiree would have very few shares left and that much fewer dollars to fund retirement going forward.

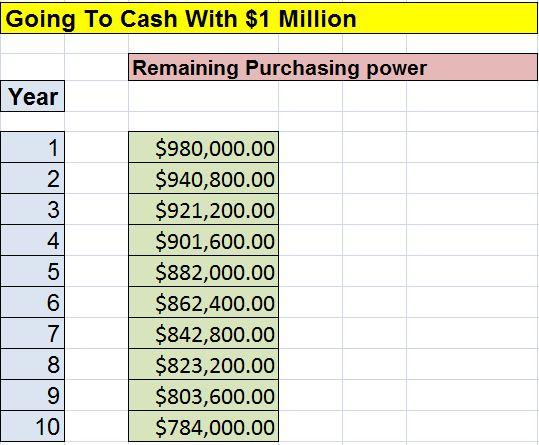

So let's take a look at what the first ten years of retirement might look like for the new retiree that decided to take all his chips off the table today, preserving his $1 million of stock market assets and going to cash. Of course, if you have accumulated less than this amount, or greater than $1 million, feel free to extrapolate these figures to suit your situation.

Going To Cash

Source: The author

We have assumed a 2% inflation rate for the entire ten year period. We have also assumed that the new retiree, keeping his cash liquid to pay his expenses, will obtain essentially zero interest on his checking account balance which is common today in the ZIRP environment.

The 800 lb. Inflation Gorilla In The Room

In the beginning years of this retirement, we find that the new retiree is suffering a small loss of purchasing power to inflation. As the years progress and that 2% loss to inflation begins to compound, we notice a larger and larger impact to purchasing power.

If you expected to see $800,000 left of purchasing power after 10 years due to 2% inflation, you weren't taking into account the compounding effect. What's left of purchasing power after these ten years is just $784,000.

If we had extrapolated these figures for a more usual 20 to 30 year retirement period, the loss of purchasing power would be stunning.

To keep things simple, we've demonstrated this loss of purchasing power as if the retiree didn't need to use these particular funds the first ten years and had no drawdown of principal during this period.

Those of us who were independent adults, paying the bills in the roaring inflation years of the 1970s through the early 1980s have vivid memories of going to the grocery store to buy our staples of eggs and milk and everything in between on Monday. When we returned to restock our pantries on Friday, we were astounded to see how prices had increased dramatically in just the course of one week. At times, these increased prices were coming so rapidly that it became quite difficult to remember the price of anything with any degree of certainty.

In our childhood years of the 1950s, the situation was quite the opposite. A quart of milk cost 25 cents on Monday and still cost 25 cents on Friday. In fact, that quart cost 25 cents on January 1st and still cost 25 cents on December 31st. And yes, I'm a baby boomer with vivid memories of my mom sending me to the store or to the milk machine to buy the milk (you buy and rent DVDs from vending machines, we bought milk from refrigerated vending machines).

Inflation is the big gorilla in the room of retirement planning in every living room in America. We have seen it range, in our lifetimes, from ferocious, uncontrollable and unpredictable to tame and less threatening. Though 2% today may feel tame, it is the compounding nature that continues to make inflation retirement enemy #1, especially in the face of a lack of meaningful wage growth and lack of interest rate compensation for savers.

That remaining $784,000 of purchasing power after ten years is just another way of saying that instead of being able to buy 500,000 dozens of eggs at a price of $2 today, ten years from now, the retiree would only be able to buy 392,000 dozens at inflation adjusted prices. That's a whole lot fewer eggs.

So even the retiree that has accumulated $1 million for his "golden years" and decides he needs to play it "safe" will come face to face with the reality of the inflation gorilla, sooner or later. What would you do?

Record Highs: The End Of The Road?

To come to the conclusion that the end is near for this bull market, simply because we are setting records, is using false reasoning. Consider this. After the Dow touched bottom eight years ago around 6500, millions of investors must have come to the conclusion at Dow 10,000 that they should liquidate their positions. How much higher could the market go after recovering more than 50%?

What were investors thinking when the Dow rose to 12,000, 15,000, then 18,000? It is a certainty that many investors concluded the market was reaching a top that would mark the end of the current bull market, and certain disaster lay ahead for investors who stayed invested.

The only thing we know for certain is that we'll never know when the top has arrived until after it has arrived. It is only in the rear-view mirror that this can be confirmed. Meanwhile, what is certain is that all those investors who cashed in their chips at those interim ten-thousand marks have left a lot on the table as they picked up their tidily winks and went home.

The other thing we are certain of is that while they missed out on the huge appreciation of their assets, what they took off the table has been buying fewer and fewer quarts of milk and cartons of eggs with every passing year.

Letting It Ride-Staying Invested

Those of us who have come to terms with the necessity of fighting inflation head-on have concluded that changing our focus from stock price to dividend income production can give us the edge we need in retirement to keep paying the bills and keep the lights on.

Strategy Session: Ring Up Verizon, Beat Back The Inflation Gorilla

In order to do successful combat with inflation, we must choose our weapons carefully. We're interested in finding high quality companies that consistently increase their earnings and grow free cash flow necessary to fund a growing income stream for us.

Verizon (NYSE:VZ) is one such company that has found a home in our Fill-The-Gap Portfolio for a number of years as well as our premium subscriber portfolio. This behemoth telecommunications, phone, internet and entertainment provider paid a dividend of $.50 per quarter, five years ago.

It recently raised its quarterly payment to $.578 per share.

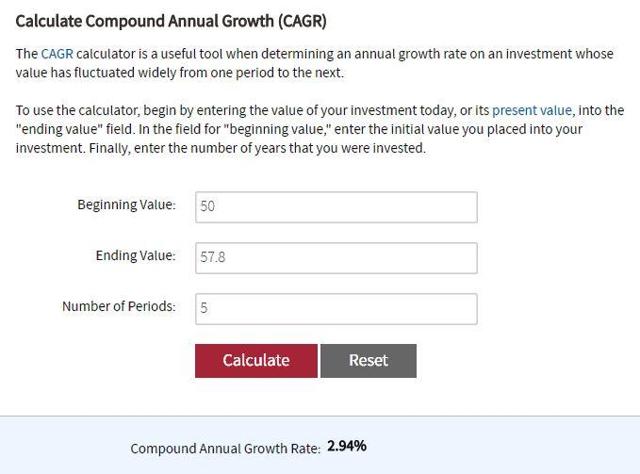

Verizon Five-Year CAGR

Source: investopedia.com

Because Verizon has grown its dividend at a compound annual growth rate over the past five years of 2.94%, we have confidence that this continued growth will overcome inflation at 2% and preserve our purchasing power going forward. As long as our income grows at a faster rate than inflation, we will always vanquish the inflation threat.

Additional Metrics We Consider

Verizon's recent 52-week high was $56.95. Shares were selling at $48.02 on Tuesday, for a hefty discount of 16%. At its high, the current $2.31 annual dividend was yielding 4.05%. Now, because of stock price contraction, the income investor can benefit from a much higher dividend yield of 4.81%. This current yield represents a betterment of 18.8% more yield and income for today's buyer.

More than 66% of Verizon's shares are held by institutions such as pension funds, banks, insurance companies, mutual funds and hedge funds which lend a great vote of confidence to this company.

Only .77% of the stock float is devoted to short positions. Not many investors believe, at this time, that the share price is going much lower from here.

The payout ratio is a relatively low 71% leaving plenty of room for VZ to raise the dividend further. Its average dividend yield for the past four years is 4.49%. This indicates that today's buyer of new shares can obtain 7.1% more yield and income than past buyers at average prices the past 4 years.

Price Contraction Gives Income Investors A Bargain Yield

Verizon Price

VZ Price and Yield

Notice that every time Verizon's price went into a tail spin, the dividend yield rose commensurately. When price recovered, yield decreased. It is the current price contraction since the beginning of this year that sets up the opportunity for income investors to benefit, once again from a much higher yield.

If we are willing to exercise patience, instead of having price dictated to us by the market, we can set our own price targets that will fulfill our particular goals for yield and income.

Here are some other examples of high-quality dividend growth stocks from the FTG Portfolio where we exercised patience, set targets and were successful in establishing positions at yield and income levels that we chose.

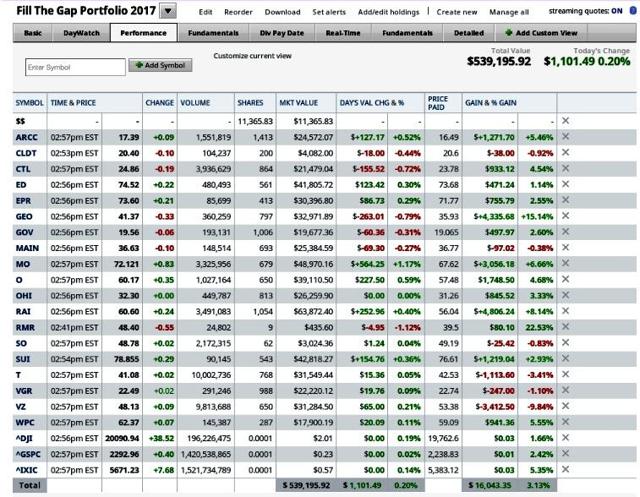

The Fill-The-Gap Portfolio At A Glance

The first article was entitled "This Is Not Your Father's Retirement Plan." This project began with $411,600 in capital that was deployed in such a way that each of the portfolio constituents yielded approximately equal amounts of yearly income.

The FTG Portfolio Constituents

Constructed beginning on 12/24/14, this portfolio now consists of 19 companies, including AT&T Inc. (NYSE:T), Altria Group, Inc. (NYSE:MO), Consolidated Edison Inc. (NYSE:ED), Verizon Communications (NYSE:VZ), CenturyLink, Inc. (NYSE:CTL), Main Street Capital (NYSE:MAIN), Ares Capital (NASDAQ:ARCC), Reynolds American, Inc., Vector Group Ltd. (NYSE:VGR), EPR Properties (NYSE:EPR), Realty Income Corporation (NYSE:O), Sun Communities Inc. (NYSE:SUI), Omega Healthcare Investors (NYSE:OHI), W.P. Carey, Inc. (NYSE:WPC), Government Properties Income Trust (NYSE:GOV), The GEO Group (NYSE:GEO), The RMR Group (NASDAQ:RMR), Southern Company (NYSE:SO) and Chatham Lodging Trust (NYSE:CLDT).

Because we bought all of these equities at cheaper prices since the inception of the portfolio, the yield on cost that we have achieved is 6.55% since launch on December 24, 2014.

In order to manage this portfolio in real time and stay on top of all of our positions, I use the Real Time Portfolio Tracker. When dips occur, I'm able to easily monitor the impact on each equity's dividend yield. This always helps in the process of layering in slowly with gradual share additions to help grow income further going forward.

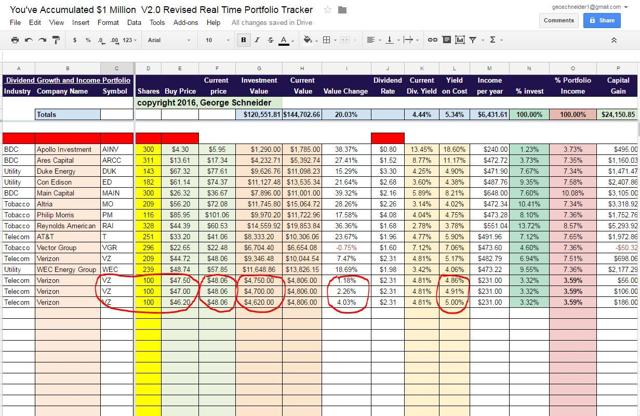

Real Time Portfolio Tracker

Here, I've used the tracker to input various target prices. Because the app calculates prices, dividends yields and investment cost all in real time, it is simple to let the app manipulate target prices to quickly arrive at the results we're seeking.

Our past purchase of VZ cost us $44.72 per share and gave us a yield of 5.17% and income for the portfolio of $482.79 per year on the 209 share position.

If we're willing to wait for a price compression of 1.18%, as indicated in column I, we can see that this will result in the yield rising from the current 4.81% to a yield of 4.86%, circled in red in column L, Yield on Cost. However, if we are a bit more patient, and decide to buy shares for $47 each, we could obtain a better yield of 4.91%. If we hold off still longer and the market cooperates with further price compression of 4.03% from Tuesday's price, we might execute an order at the $46.20 level. This would get us a significantly higher yield of 5.00%.

For the same 100 share position contemplated, we are able to see the effect on our investment cost with each price contraction, also circled in red in Column G.

In real time, the app also feeds us with important metrics that include the current value of each of our positions, the percentage change in value from our buy price, current dividend yields, yields on cost based on our buy price, the dollar income each constituent contributes to overall portfolio income, the percent of income each represents and our capital gain from each position as well as the total portfolio.

This is one of many ways we monitor the FTG Portfolio in real time and make adjustments to holdings as opportunities present themselves.

FTG Portfolio Close, February 7, 2017

Conclusion

Hitting new, record highs in the market creates exhilaration in some investors' minds, and strikes fear in the hearts of others. Some fear their gains will all disappear and are driven to consider cashing out now while the gettin' is good.

While some consider playing it safe and protecting their capital at all costs, others understand the need to battle inflation through dividend growth investing. These investors find comfort in knowing their dividend income will see them through the worst of times, like the 2007-2008 financial meltdown.

Being patient, being proactive and setting targets can result in much higher income than otherwise would be the case. What would you do?

Author's note: Should you be interested in reading any of my other articles detailing various strategies to enhance your returns on a dividend growth portfolio, you will find them here.

I invite you to follow me in order to be notified of all of my new work on a real-time basis. Simply click "Follow" next to my picture, then choose "Follow this author" and "Real-time alerts on this author."

As always, I look forward to your comments, discussion and questions. Please share your thoughts. Have you been thinking of cashing out to protect your capital or have you been lying in wait to pounce on the next bargain to increase your income?

As part of our premium subscription program, all subscribers receive a FREE Portfolio Income Tracker to track income production in the subscriber portfolio and stay focused on income production in their own portfolio. For two days, only, new subscribers can also choose thetool of their choice for FREE.

To learn more about this premium service, please click this link:

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am/we are long T, MO, ED, VZ, CTL, , MAIN, ARCC, VGR, EPR, O, SUI, OHI, WPC, GOV, GEO, WPC, RMR, SO, CLDT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

.jpg)