Executive Summary

On the afternoon of Thursday, November 16, 2017, the Energy Information Administration (EIA) held a Webinar to discuss “Forecasting U.S. Crude Oil Production.” The Webinar was held in response to recent concerns regarding EIA's forecasting of U.S. shale oil production and the impact EIA’s forecasting has on crude oil prices.

The Domestic Energy Producers Alliance (DEPA), an industry group of American oil producers led by shale oil tycoon Harold Hamm, believes that the EIA’s 2017 forecast for the U.S. shale oil production exit rate level (that is, the December production figure) has been too high and is depressing the price of West Texas Intermediate (WTI) oil prices.

Currently, the EIA’s “Monthly Crude Oil and Natural Gas Production” reporting is on a two-month lag. Therefore, the EIA’s forecast covers not only future months, but months that have yet to be reported. The last "Monthly Crude Oil and Natural Gas Production" report released by the EIA on October 31, 2017 covered production through August (so until November 30th, the forecast of U.S. shale oil production covers the four months September to December).

America’s oil resurgence and its large share of excess global inventories (over 5-year average inventory level) mean that EIA’s forecasts have a significant impact on WTI pricing. The DEPA believes that the EIA needs to improve its forecasting methodologies to be more timely and responsive to rapidly changing shale oil industry dynamics.

According to the DEPA, the EIA’s current forecasting methodology (U.S. “actual” oil production reporting is on a two-month lag) which has resulted in overstating the 2017 shale oil production "exit rate" has cost U.S. shale oil producers over $4 billion in revenues and royalties in 2017.

The BOTTOM LINE: DEPA believes the overstatement of U.S. shale oil production estimates for September to December will be revised sharply lower and the price of WTI crude oil should be $4.00 to $5.00 higher.

EIA Presented Basis Of Its STEO Oil Production Forecast

The EIA’s "Short-Term Energy Outlook" (STEO) is published monthly and provides a forecast of U.S. oil production for the short term (currently for 2017 and 2018). John Staub, Director, Office of Petroleum, Natural Gas & Biofuels Analysis, gave a presentation “Forecasting U.S. Crude Oil Production” during the Webinar.

The EIA's John Staub provided an explanation of the factors affecting its Short-Term Energy Outlook oil production and two key elements of its 2017 forecast:

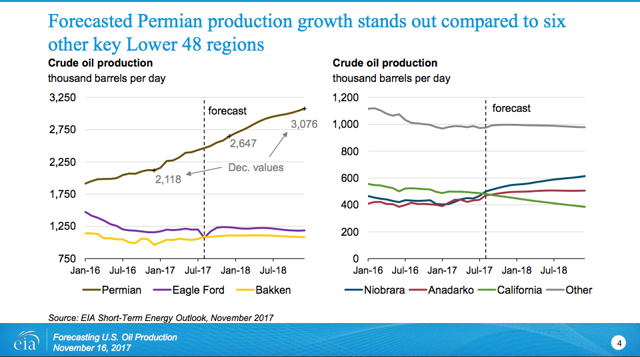

- The forecast by major U.S. shale oil basin (clearly, the Permian basin is the story for 2017).

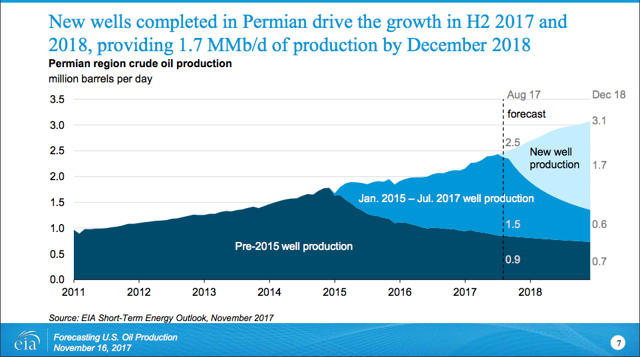

- The breakdown of the Permian basin forecasts represented by the age of well (those put into production pre-2015, 2015 to July 2017, and new wells post July 2017).

Due to the nature of the shale oil production industry, the 2017 EIA exit rate forecast of production from the Permian basin is predicated to a large extent on estimates for future drilling performance and the type curve declines for recently completed wells.

DEPA Makes Its Case That EIA Is Overstating 2017 Exit Rate U.S. Oil Production

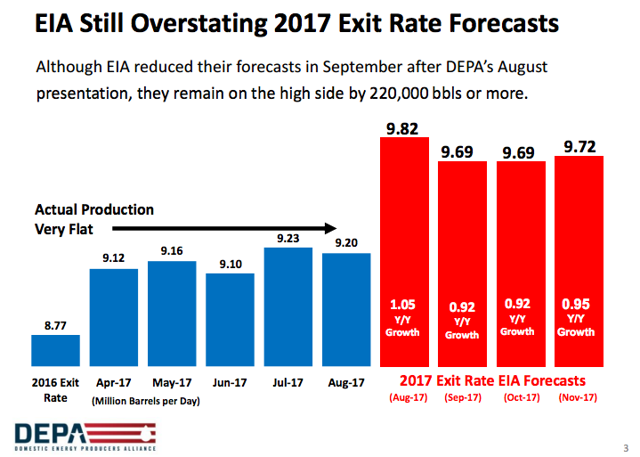

DEPA Chairman Harold Hamm made a presentation that focused on the fact that U.S. shale oil production growth has been relatively flat over the past several months and that the EIA is overstating its forecasted 2017 oil production "exit rate."

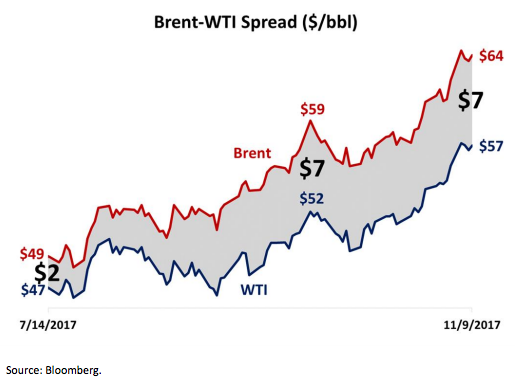

As a result of EIA’s over-estimation of U.S. shall oil production, the WTI is trading at a higher discount to the Brent, due to fears that America shale oil producers will grow production sharply and flood the market. The Brent-WTI Spread has grown from approximately $2 per barrel in mid-July to approximately $7 in November 2017.

Two Charts Highlight The Disagreement Between the EIA And DEPA Estimates

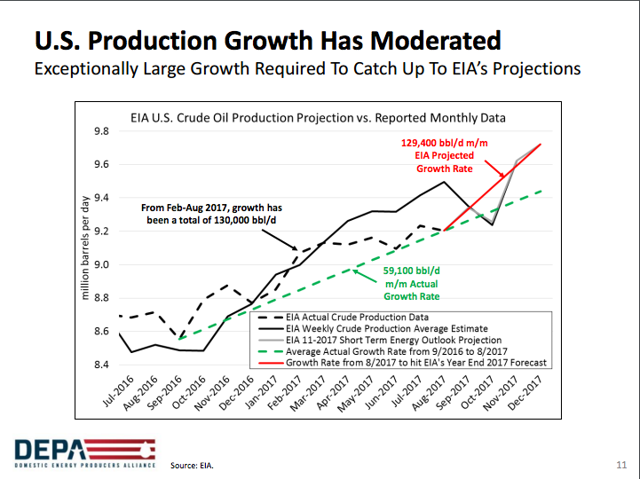

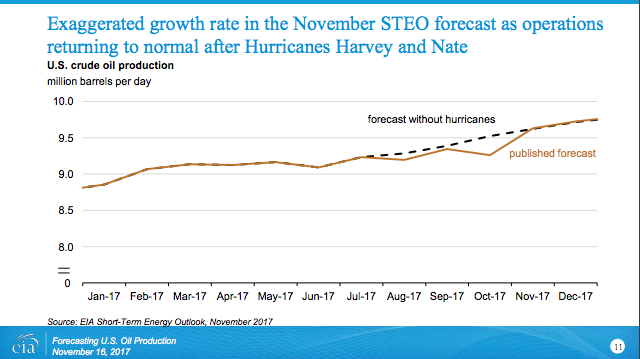

The STEO estimate is based upon EIA’s forecast methodology (as spelled out in detail in Staub's presentation) and accounts for the effects of the summer hurricane disruptions.

The DEPA forecast is based upon the most recent actual crude oil production. DEPA argues that changing shale industry dynamics including: peaking of drilling efficiencies, lower performance expectation for child (in-fill) wells, and maturation of the Permian basin will result in more moderate growth. The chart below shows the difference in the actual trend and the sharp uptick in production required to achieve the EIA's forecast.

Production Forecasts May Be Cut, But The WTI/Brent Spread May Prove Resilient

In Forge River Research’s opinion, we believe DEPA may prove right in EIA’s U.S. crude oil production forecast being too high by 220,000 barrels of oil per day (about 6.6 million barrels per month) or more.

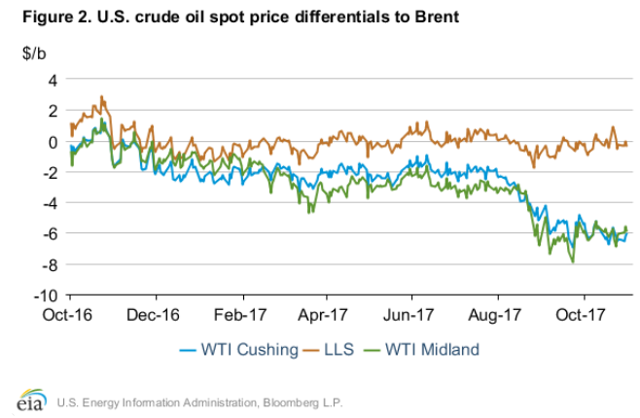

However, in our opinion, the WTI/Brent Spread (see Figure 2 from the EIA’s September 2017 STEO report below) is not likely to close as much as the $4.00 to $5.00 the DEPA says. We believe much of the WTI/Brent spread differential is due to supply dynamics of light sweet crude oil and the additional transportation costs to move the oil to refineries and to the Gulf of Mexico for export.

Therefore, a lower U.S. shale crude oil forecast would be bullish and ease concerns about inventory draw-downs turning into inventory additions. We believe the contraction of the WTI-Brent spread currently at about $6 per barrel (on November 17th) may be less than the DEPA’s expectation of a $2.00 to $3.00 spread.

What It Means For Investors In Shale Oil Producers

Many shale oil producers still remain highly leveraged and committed to significant capital expenditure programs to grow revenues, maintain leases, and prove up acreage. At over 5 million barrels of shale oil per day, a $1 improvement of WTI crude oil prices translates into approximately $150 million in additional shale oil producer profits per month ($1.8 billion per year). If the WTI were to increase $3.50 (closing the WTI-Brent spread to $2.50), that would translate into $525 million in additional U.S. shale oil producer profit per month ($6.3 billion per year).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.