Arabica coffee futures that trade on the Intercontinental Exchange can be one of the most volatile markets in the world of commodities. Brazil is the world's leading producer of the Arabica beans and the weather and growing conditions in the South American nation each year is a critical determinate of the path of least resistance for the futures market.

Coffee is a beverage enjoyed around the world. Not only do many people start their day with a cup of java, but many also consume more than just one. Caffeine is a powerful stimulant that has addictive powers. At the same time, coffee is also a social experience. In Europe, the coffee shop has been a central part of life for many years. In the United States, Starbucks and other storefront businesses have tremendous appeal for those looking to socialize, watch the world go by, or grab a cup of coffee on the go. As an agricultural commodity, it is the supply and demand fundamentals for coffee beans each year that determines the path of least resistance for prices. Weather and crop disease are often the most significant factors, but growing demand from an increasing world population provides support for prices on a longer-term basis.

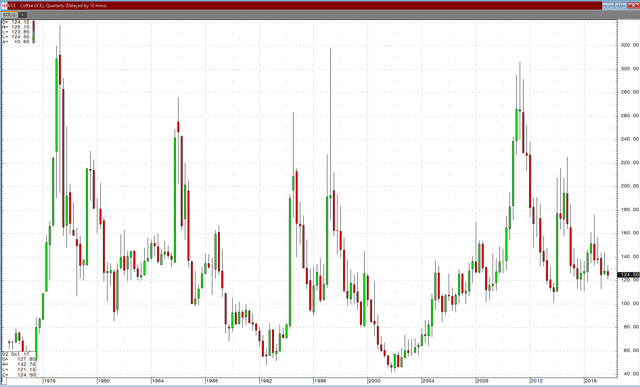

Despite the increasing number of coffee drinkers around the world, the price of coffee futures has been in a bear market since November 2016.

Lower highs since November 2016

The price of coffee has been making lower highs since trading at $1.76 per pound one year ago, in November 2016.

Source: CQG

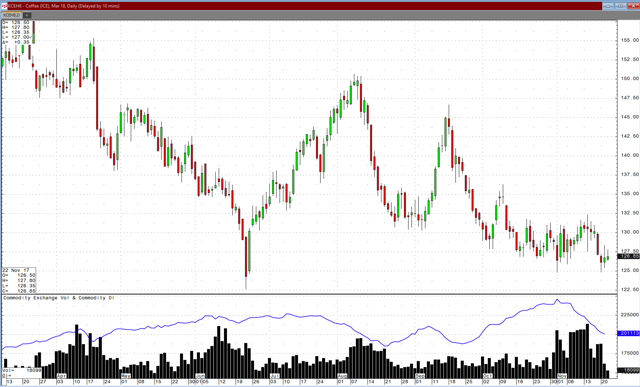

As the weekly chart highlights, bear market price action because of ample supplies has caused consumers to enjoy lower prices for their daily coffee habit over the past year. ICE coffee futures were also making lower lows until June when the price of nearby futures fell to lows of $1.13 per pound which appear to be a significant bottom for the price of the java beans. Since the June lows, coffee has not rechallenged the bottom and price momentum on the weekly chart has declined into oversold territory as the price of the soft commodity has been consolidating around the $1.20 to $1.30 per pound level. Historical volatility, a measure of price variance, has dropped to 17.81% which is a low level for the commodity that tends to exhibit wide price ranges on a daily, weekly, and monthly basis.

Coffee is the main cost of goods sold input for companies like Starbucks (SBUX) and Dunkin Donuts (DNKN). Therefore, the prices of both stocks are highly sensitive to changes in the price of the coffee futures market.

Source: CQG

The chart of DNKN shows that shares traded to highs of $59.70 in June when coffee was on the lows and are currently lower at the $56.35 level. The action in Starbucks shares points to the sensitivity of the price of coffee to the earnings of the company.

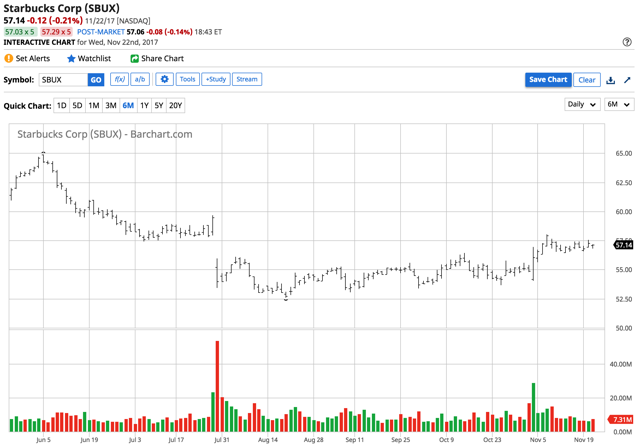

Source: CQG

SBUX traded to a high of $64.87 on June 5 around the time that coffee hit lows for the year at $1.13 per pound. With coffee trading at the $1.24 level on the expiring December futures contract, the stock was at the $57.14 per share level. Coffee is up around 10.2% since June and SBUX is 11.9% lower.

Many companies where earnings are a function of a critical cost of goods sold input hedge their medium and long-term price exposures via the futures market. However, when it comes to coffee, each year is a new adventure when it comes to the crop and weather and crop disease can cause lots of price volatility. While futures are liquid instruments for the short-term in the java market, the medium and long-term are a different story. Coffee beans have a limited shelf life, and while the futures market offers contracts out to 2020, liquidity is insufficient making hedging a challenge for significant consumers of the beans. Therefore, the earnings of companies like SBUX and DNKN can change dramatically with price volatility in the coffee futures market.

Meanwhile, the weekly chart shows that coffee is currently displaying an oversold condition and the level of technical resistance has moved lower with the price over past months.

Technical resistance has moved lower

Commodities are volatile assets. In the world of raw materials, few have the penchant for price variance that we have seen over the years in the coffee market. Coffee is a commodity that can double or halve in price over short periods as changes in the weather or crop diseases like leaf rust can destroy a crop in days.

Source: CQG

The daily chart of March coffee futures shows that while the highs have been getting lower, technical resistance has also declined dramatically. On August 8, March coffee futures made a high at $1.5070 per pound which stood as the technical ceiling on the upside until its next lower high on September 18 at $1.4665. Then, on October 10 another lower high developed at $1.3625 per pound which stood as the ceiling until the most recent short-term high at $1.3230 on November 14. Technical resistance on ICE coffee futures has been dropping with price, and a move above the current level at the November 14 high could trigger lots of short covering in the coffee futures market.

Open interest falls through the December-March roll

Over recent sessions, coffee futures that trade on the Intercontinental Exchange have been rolling from the December to March series. As the daily chart illustrates, open interest has been declining as the contracts have been rolling. Open interest is the total number of open long and short positions in a futures contract. In coffee, the metric has dropped from 245,897 contracts on November 1, which was a record high, to its current level at 201,113 contracts. The decline of 44,784 contracts or 18.2% over the past three weeks is a sign that the price action has caused many shorts to take profits rather than rolling their December shorts into March at low prices. Moreover, in the world of futures, declining open interest and falling price is typically not a sign of the continuation of a bearish trend in prices.

Closer to lows than highs

In the world of commodities, prices tend to fall to levels where demand increases, production slows, and inventories begin to decline. At that point, price action that takes the commodity above a technical resistance point can trigger a tsunami of buying bringing the price to much higher levels as trend-following speculative traders hop on board an emerging bullish trend.

Source: CQG

As the quarterly chart of ICE coffee futures shows, while the soft commodity has been making lower highs since last November, the price has been making higher lows since 2013 and that year it only reached a marginal low below the 2008 bottom by less than one cent. Discounting that 2013 spike below the 2008 bottom, the coffee futures market has been making higher lows since 2001. At prices between $1.20 and $1.30 per pound, coffee is a lot closer to lows these days than highs. The bottom from 2013 was at just over $1 per pound, and the peak from 2011 was at $3.0625. Risk-reward favors the price of coffee on the upside from a long-term perspective.

The weather in Brazil and global demand

The weather in Brazil over coming weeks and months will determine the coffee crop and the path of least resistance for the soft commodity. However, the quarterly chart displays a trend that has developed in many other agricultural commodities. The growth of population and wealth in the world over past decades has been staggering. I was born in 1959 when there fewer than 3 billion people on the earth. Baby boomers like me have seen the population of the world more than double during our lifetimes. More people means more demand for finite commodities and many more coffee drinkers.

The long-term trend of higher lows in coffee is not a function of just the java market, but it exists in many other agricultural commodities that trade in the futures markets including, corn, soybeans, wheat, sugar, cocoa, cotton, cattle, hogs, and even frozen concentrated orange juice. The fact is that demographics have been lows higher during glut markets. When shortages occur, we have seen some fantastic moves to the upside. The drought in the U.S. in 2012 resulted in record highs in the corn and soybean markets. Citrus greening in orange groves led FCOJ futures to rise to an all-time peak in November 2017. There are many other examples of how the downside limit when it comes to the prices of agricultural products is increasing and the upside is explosive these days. This trend is likely to continue and could become more pronounced in the years ahead as population and wealth rise around the world.

Therefore, with coffee futures trading close to lows, the risk-reward value proposition favors the upside. Be careful if you are holding long positions in SBUX or DNKN in your portfolio. The next surge in the price of coffee beans could weigh heavily on the prices of these stocks as it will eat away at profit margins and earnings are likely to decline.

Each week in The Hecht Commodities Report, I provide subscribers with up, down, or neutral price bias based on a combination of fundamental and technical analysis. The report is a useful ready reference for investors who trade or invest in futures and options markets, and in ETF and ETN products.

As a holiday special, I will be offering a two-week free trial for The Hecht Commodities Report in December. The free reports will be available late in the day on December 13 and 20. The price will also be going up as of January 1, 2018. But if you subscribe before December 31st, you'll be grandfathered in at the current low price for the lifetime of your subscription.

Disclosure: I am/we are long JO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.