Introduction - The old familiar valuation concerns reach the upper echelon

When an idea that makes sense gets ignored for years, then bubbles up to the Bloomberg News and Goldman Sachs (GS) level, it's worth paying attention to, because the concept may finally be ripe. The immediate issue is one of great importance to all investors, even ones with a 10-year horizon. It was covered by Bloomberg Wednesday in Goldman Warns Highest Valuations Since 1900 Mean Pain Is Coming. I've been talking for years about this phenomenon, which is likely due to QE more than anything, and now that these heavy hitters are focusing on it, it may finally be time.

Here's a brief summary of the article, which itself is brief.

High stock and bond valuations: implications according to Goldman

Here are the two sub-headers from the article that make the main points:

-

Returns likely to be lower across all assets in medium term

-

Risk scenario sees inflation jump that ushers "fast pain"

To flesh it out a bit, here are the opening two paragraphs:

A prolonged bull market across stocks, bonds and credit has left a measure of average valuation at the highest since 1900, a condition that at some point is going to translate into pain for investors, according to Goldman Sachs Group Inc.

"It has seldom been the case that equities, bonds and credit have been similarly expensive at the same time, only in the Roaring '20s and the Golden '50s," Goldman Sachs International strategists including Christian Mueller-Glissman wrote in a note this week. "All good things must come to an end" and "there will be a bear market, eventually" they said.

There is more in the article, including a graphic that carries a lot of information. Goldman strategizes overweighting stocks and underweighting long-term bonds.

The article repeats other relevant points that the Goldman research note makes, but the ones I would like to focus on come from the bullet points in the Bloomberg article. Namely, are returns really "likely to be lower" across "all assets" in the "medium term" (defined as what)?

To do that, the variable that Goldman points to as most operative is the one many of us have pointed to for years, namely QE and reversal of QE (also called quantitative tightening).

Do we really have any idea what any or "all" assets are going to do in any time frame?

This is a strong statement. There are too many influences on asset prices to make this sort of prediction. Note that I am responding to the Bloomberg article, and do not have access to the Goldman piece in its entirety.

Given the latest weekly Fed balance sheet data, it is possible that the Fed has indeed begun its reverse QE program, as it says it has. I think this is a headwind to general asset valuations, but headwinds are only one influence. So I'd be careful about getting grandiose about what any one "known known" will lead to.

But Goldman and Bloomberg do have a point:

Reverse QE is an anti-liquidity action. So were, in a different sense, the three times that QE 1, 2 and 3 ended. Each of those episodes were followed by bear moves in fixed income (rising rates) reversing. QE 1 and QE 2 were followed by weakness in gold (GLD) and silver (SLV). The onset of QE 3 saw the inflation-linked metals and oil briefly soar, then plunge; and they have never really recovered.

All this makes sense in thinking about the current liquidity reduction program of reverse QE, which is scheduled to be doubled in amount in January-March and then ramped higher from there if the economy cooperates.

Think of the prior crisis management of late 2008 through the Taper of QE 3 in 2014. Then, the more aggressive, crisis-driven policy was QE (liquidity injections aka "money printing"), and the status quo, more optimistic policy was to keep the money supply stable. In those more optimistic periods, interest rates declined; they rose during QE when it was "risk on" in the markets.

Now, the Fed is confident that the crisis is over, so the optimistic view of the economy is to reverse QE and return toward normalcy. A bearish view of the economy, and possible simply a downshift toward low inflation, would be reflected in not ramping reverse QE, suspending it, and/or dropping the short-term interest rate. However, absent major crisis, renewed QE is now off the table.

This scenario could actually produce good, even double-digit, annual returns for many stocks and reasonable results for bonds, because it could lead to declining inflation, stable long-term rates, and stable to rising P/Es if equity earnings yields get compared directly to yields on corporate debt, a comparison I have been making lately on Seeking Alpha.

Reverse QE is disinflationary

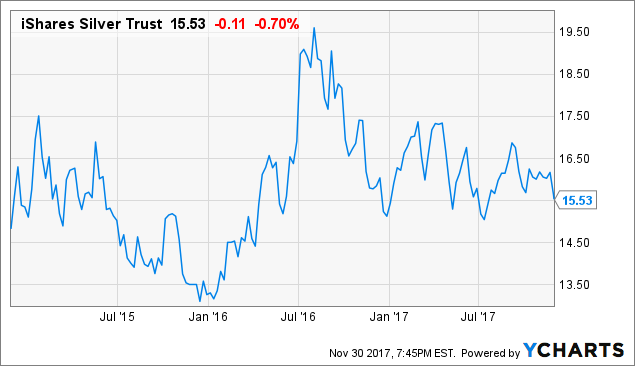

By now shrinking the base money supply, the Fed is essentially giving up on its fight to increase inflation. Fewer dollars in bank and money market deposits chasing an increased supply of goods and services (the economy is growing at about a 2.5-3% rate right now) tends to be disinflationary or deflationary. It is in this context that I interpret the move in SLV as reflecting this three-year stagnation in the money supply (from end of QE 3 in 2014 until October) and now the slight decline:

That was a three-year chart. On a five-year chart, we see the gold mining stocks (GDX), which tend to lead GLD (which is acting a little better than SLV), weak as well:

GDX data by YCharts

GDX data by YCharts

Crude oil is uptrending. However, the out years show much lower expected prices than the front months. Backwardation is a warning about current cycle strength and longer-term price weakness.

All this is in the setting in which the Fed's favorite inflation measure, PCE, is only up about 1.5% yoy. This comparison could easily drop as the base money supply shrinks on schedule. The amount of base money shrinkage is large, even for the US economy; it is set to shrink by $420 B in 2018 and $600 B in 2019.

However, since the shrinkage is in excess bank reserves, which are not needed for the real economy, the flow of goods and services can continue unhindered as the Fed reverses QE.

How reverse QE can help strong stocks and cash-like instruments

I do think that inflation hedges and weaker companies, such as those with leverage and without strong business models, can be classic victims of the change in Fed policy. However, focusing on stronger companies - and the US public markets have many - produces different potential outcomes from a reversion toward monetary normalcy. First, we need to think of the earnings yield paradigm in which stocks, especially stocks with high conversion rate of earnings to free cash flow, compete with bonds. This is different from the old paradigm that perma-bears such as John Hussman go by, in which depressions with deflation were associated with depressed stock valuations and low interest rates.

Now we have seen governments and their central banks create vast amounts of new money "out of thin air," driving short-term interest rates to near or even below zero, and either directly or indirectly pulling long-term rates down. This was accomplished with no significant amount of deflation even in Japan or the EU, and with no deflation in the US at all using the core PCE measurement even for the Great Recession period. So the idea that bonds are safer than stocks, thus there should be an "equity risk premium" in which, all else equal, bonds should be preferred to equities, makes little sense - if any. Rather, all that matters is total return in this view.

At the same time, the free market is now valuing long-term bonds fairly freely, now that the UK has stopped QE long ago, the US is already reversing it, and the EU is planning to taper or stop it next year. And what do we have? The UK issues a 30-year bond, and the yield is a tiny 1.83%. Australia, which never did QE, apparently has no Federal government bond longer than 15 years, and the yield is 2.80%. Australia used to be a high interest rate country, but the free market has put yields very low as well, just slightly above US Treasury rates. Canada, with no QE, enjoys a 10-year government borrowing rate of only 1.84%.

So while stocks should not be discounted any longer with an equity risk premium (i.e., be valued lower than bonds just because they are stocks), bonds may have a case. This can be especially so because current inflation rates in the US reflect the approximately $2 T of base money that the Fed wants to withdraw from bank and money market accounts. Absent the pressure of all that money, inflationary pressures may well decline.

Let me sum up in a little detail.

Conclusion: dealing with high valuations as QE goes into reverse, part 1: bonds

Goldman works off of a key point. The Bloomberg article says that:

As central banks cut back their quantitative easing, pushing up the premiums investors demand to hold longer-dated bonds, returns are "likely to be lower across assets" over the medium term, the analysts said.

There is clearly some logic here; I have been pointing this out in various ways for quite some time. But we can look around and see a rationale for optimism as investors.

When the mythical Mr. Market was really worried about long-term inflation in 2010-11, "he" pushed the spread between short term, T-bill rates and the 30-year T-bond rates to nearly 4%; the 2-30 spread was nearly that high. Now, the spread between 1-30 spread is only about 1.3% (130 basis points), and the 10-30 spread has dropped from about 100 basis points in H2 2013 to 40-45 basis points. Investors are looking at lots of supply of high-quality, long-term bonds, both Treasuries, corporate and municipal, and are looking at QE going away, and they are judging that the future will have low inflation. Why should inflation be low going forward? Perhaps these reasons: demographics, productivity gains and the fact that the Fed has thrown trillions of new dollars at the system, and we still do not even have 2% PCE inflation. Markets may also be pondering the deconstruction of some of the administrative state in the US, which could be disinflationary or deflationary.

In summary, I would first agree with Goldman that reverse QE is a highly consequential process, and that removing perhaps $2 T of base money that the Fed created for a reason cannot in and of itself push asset valuations higher, nor can it provide additional economic stimulation. So I would be cautious about speculating in weaker stories now than in, say, 2014, when QE 3 was going on.

But then I would take a different emphasis than Goldman. Reverse QE is in my analysis both friendly and unfriendly to long-term bonds. It appears friendly for the disinflationary reasons mentioned above and unfriendly because the article is correct that the bond complex, across all durations, will be seeing fewer dollars available to compete for a similar supply of debt. Less demand means, all else equal, lower prices, which in bond-land means higher interest rates. I happen to think that this effect will be concentrated at the short-to-intermediate term part of the bond complex, where rates are clearly unattractive and where most of the issuance occurs. So, I remain sanguine about very high-quality, long-term bonds such as Treasuries, AAA-rated corporates, etc.

Conclusions, part 2: stocks

I partly agree with Goldman that stocks may be more attractive than bonds, but only high-quality stocks with normal valuations and high enough quality that we can forecast their earnings yields (reciprocal of the P/E expressed as an interest rate) several years hence. These stocks would range from the well-known blue chips to stronger smaller stocks that have never received the valuation step-up they might. In thinking of Goldman's thesis of low forward returns, I'm not that impressed for these many stocks. That's because on an earnings yield basis, many high-quality stocks with secular growth characteristics are cheap to their own bonds and can see P/Es rise, not necessarily fall. Consider a long-term Apple (NASDAQ:AAPL) bond maturing in 2045 with a yield to maturity of only about 3.7%. Well, AAPL has a forward earnings yield near 7% right now based on prospective calendar year 2018 earnings, and usually all of AAPL's earnings are equivalent to its free cash flow. AAPL is my #1 stock, as it has been much of the time since I first bought it in January 2010 upon its announcement of the iPad at a split-adjusted $28-29 price. Within tech, a lower forward earnings yield than AAPL's but still an attractive one is found in Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL). Using about a $42 EPS for 2018 and a stock price for the class A shares of $1,033, the forward P/E is 24.6X and the earnings yield is 4.1%. If GOOGL had much long-term debt, I would expect it to carry a yield equal to or lower than that of AAPL. Even if its Other Bets do not pay off well, GOOGL is expected to have substantial growth from its core businesses, thus a forward earnings yield of 4.1% is expected to step up rapidly.

Information technology remains a secular growth area that I believe can easily trade at much higher relative valuations to the debt securities that companies in the sector issue.

Another secular growth area that is cheaper than Internet stocks is biotech. Many biotechs trade with trailing P/Es in the teens, and most other large names are below 25X. Even with near-term challenges, they are attractive longer term in my view. In a period of diminishing liquidity as reverse QE moves along, I favor the operationally and financially strong biotechs (NASDAQ:IBB) over the little guys (NYSEARCA:XBI).

Given the prospects for positive economic growth, many cyclical stocks are attractive when not worrying about equity risk premia and simply focusing on actual returns. One of the interesting changes in cyclicals is that many now perform little capital spending and have become strong free cash flow generators. So, take Deere (DE), which is partly a technology-driven company now. Consensus EPS for CY 2018 may soon be around $8.50. At its current price around $149, that gives an earnings yield around 5.7%. This is far above the yield on DE bonds. And DE is still not even back to mid-cycle on US/Canadian tractor sales. So, while DE does not have the stellar prospective returns it had a year ago, I own the stock, not its bonds. And so on. Plus, DE may benefit from a corporate tax cut.

One more sector is worth mentioning, namely restaurants, which have been out of favor for some time, except for McDonald's (MCD). If the consumer economy carries on, these sorts of stocks may begin to outperform the cyclicals, which may lose attractiveness as the Fed pushes short-term rates higher (finally!) and the industrial cycle matures. Domestic restaurant chains pay high tax rates and thus can be big beneficiaries of a tax cut. I remain long a good deal of Darden (DRI), which controls Olive Garden and several other concepts. The stock is around $85 and the current yield is 3.0%.

For strong stocks, such as those listed above, and given positive real growth and 1-2% inflation, we can think about P/Es holding steady or even rising in my lower-for-longer interest rate scenario on the long end. In that case, the owner of the business - i.e. the shareholder - owns the free cash flows, receiving some as dividends and indirectly owning the rest, presumably to receive these earnings later. Thus Goldman/Bloomberg may be a bit too negative on forward returns from many equities even as the Fed normalizes policy.

Summary and final thoughts

1. When Goldman Sachs and Bloomberg News begin to demonstrate graphically just how extreme combined stock-bond valuations are, then this metric may finally matter. This warning in conjunction with reverse QE from the Fed and its related ongoing interest rate-raising program.

My interpretation is that the first securities to be affected by these points will be more marginal, weaker ones.

2. Rising short-term and intermediate-term interest rates are again being associated with relatively stable rates above 20 years maturity. Since 1981, this curve flattening or inversion process has signaled continued disinflationary pressures. Thus, long-term bonds may provide modest positive returns after inflation and may hold their trading price, i.e. yields may stay range-bound, with both upside and downside possibilities to be considered. Goldman focuses on the rising inflation, rising rate possibility, but the action in GLD, GDX and SLV, as well in Treasuries (TLT) makes me give at least equal weight to the opposite scenario as the Fed shrinks the base money supply at an accelerating rate.

3. In the modern era, with widespread monetary manipulations by central banks now the New Normal, and with support of stock prices (SPY) semi-official policy, there is good reason to view equities of dominant, strongly FCF-positive companies as inherently as attractive as bonds, or more attractive. If and when inflation comes roaring back, only equities give inflation protection; in the other direction, the old-fashioned risk of serious price deflation is simply off the table for the indefinite future.

Thus I agree with Goldman that certain stocks are more attractive than bonds, but I would take a more optimistic tone about equities. Rather, I look at many equities as providing what, in context of competing assets, are attractive earnings/FCF yields right now, with the prospect of long-term growth of those cash flows. Total returns from many stocks may turn out very well on all foreseeable time frames from this perspective even as the Fed goes through what may be a prolonged tightening cycle. Of course, ups and downs cannot be predicted, but in 1995-2000, there was no QE and stocks got a little crazy on the high side in their valuation. If that happens again, then I would sound the alarm about equities. But not now.

Thanks for reading and sharing any comments you wish to contribute.

Disclosure: I am/we are long SPY, AAPL, GOOGL, DE, DRI, TLT.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not investment advice. I am not an investment adviser.