Recently one of our subscribers requested that we provide an analysis of the Global X S&P 500 Catholic Index ETF (CATH). It took nearly 18 hours to do it by hand but his response was worth it! So, we decided to do two things: share the results with the Seeking Alpha community and create a tool for our Friedrich Global Research subscribers that is easy to use and fast. This article represents the first of the two tasks and we are well underway on the second, though the finished product schedule remains unknown as yet.

The Catholic Fund Analysis

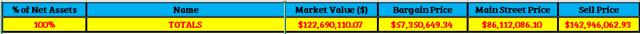

Here is a summary of the results in the simplest of terms:

According to our Friedrich algorithm this ETF would be rated a hold as it remains below its sell price. The market value is above both our Main Street Price (estimated intrinsic value) and our Bargain Price but as long as it does not become too overvalued we tend to let the winners run.

As you can see, the fund is currently valued at $122,690,110 (using our proprietary valuation methodology based upon free cash flow) and its fully valued price is $142,946,062 meaning that it has about 16.50% upside left.

But, at the same time, in order for the fund to equal its Main Street Price (our estimated fair value) it would need to fall -29.8%, and to actually become a bargain it will need to fall -53.5%. If a recession were to occur many stocks (and ETFs, by extension) would likely fall to bargain price levels. Thus the fund has limited upside but in a bear market could get creamed.

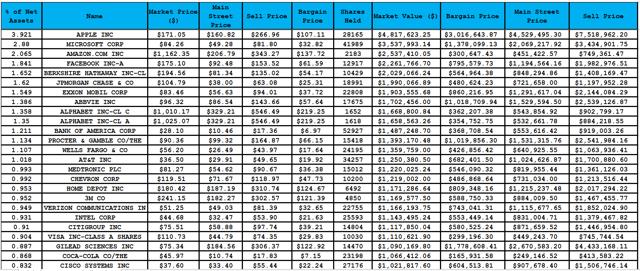

We will compare these results to our Friedrich Final Four Model Portfolio later in this article to provide a contrast and an alternative with greater future upside potential (over 300%), again based upon our valuation methodology. But first, we present the results for the top 25 holdings of the ETF:

The ETF has a total of 468 holdings so displaying all positions would be overkill, so hopefully you get the idea of how the assessment works from the example provided above.

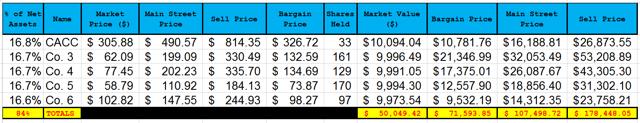

Our Friedrich Final Four Model Portfolio contains only six holdings, two of which we have written about publicly, so we will disclose those in this article but the remaining four will be reserved for our subscribers.

The portfolio at approximately $60,000 has a sell price of $269,164 which equates to a 349% potential upside and would need to go up 80% before it reaches its Bargain Price and 170% before it reaches its Main Street price. We launched this portfolio on August 6, 2017 and the unrealized gain to date is 21% while the S&P 500 is up +5.06% over the same time frame. The stocks in the Final Four portfolio are considered bargains by Friedrich while only about 10 of the 468 stocks in the CATH ETF are. This is what we call investing for appreciation with capital preservation. We prefer to not incur big losses.

Now, we understand that many folks out there will cry foul regarding the valuation or Netflix. Our methodology does not necessarily provide a one-year target price, per se, but rather it projects the future value at some point in the future. Again, we understand that this will not set well with purists but the proof is in the pudding, so to speak, as the results speak for themselves.

At the end of 2014 our algorithm set the bargain price for NFLX at $416.38 while the price was at $48.80. Nearly every analyst on the planet, including myself, said it was overvalued then. The stock price has risen about 300% since then and the same analysts are still screaming about the overvaluation (except me). We do not believe that the portfolio will rise 349% in the next 12 months. But on a relative basis we do believe that there remain much more potential upside appreciation in these stocks than in the stock contained in any ETF we have analyzed and by a wide margin.

And even if we take Netflix (NASDAQ:NFLX) out of the equation completely the results are still strong:

The potential appreciation, according to our model in this scenario is still 256%.

The Next Investing Tool

We cannot say when we will be able to make this new analysis tool available to our subscribers because it will take a load of programming to make it available on a secured website. But we are committed to making it happen. Just like we developed a method of using the algorithm to identify stocks to short because subscribers asked for it. That has been very successful so far, too.

Our aggressive growth portfolio is also beating the SPDR S&P 500 ETF (SPY) by a wide margin even though it remains 30% in cash. That is a very nice pond to be fishing in.

The tool will require users to enter the ticker symbols of holdings and the number of shares held for each. The rest will be done automatically. Or, at least, that is the vision. And it will enable subscribers of Friedrich Global Research to assess their own portfolios in minutes. Or they could analyze any ETF or Fund for which they know the holdings.

The biggest benefit will be the ability to compare one fund/ETF against another or to assess multiple allocation/holding alternatives for a portfolio. We shall continue to work diligently on this project until it is complete. When it has been tested and made available we will make sure that all of our real-time followers are made aware immediately.

If you have any questions, please feel free to ask them in the comment section below and don't forget to hit the "Follow" button next to my name at the top of this article. For those who would like to learn more about my investment philosophy, please consider reading " How I Created My Own Portfolio Over a Lifetime."

Disclosure: I am/we are long NFLX, CACC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: DISCLAIMER: This analysis is not advice to buy or sell this or any stock; it is just pointing out an objective observation of unique patterns that developed from our research. Factual material is obtained from sources believed to be reliable, but the poster is not responsible for any errors or omissions, or for the results of actions taken based on information contained herein. Nothing herein should be construed as an offer to buy or sell securities or to give individual investment advice.

.jpg)